Investment Outlook 2025

US equities and the dollar have delivered a ringing endorsement of Trump. What now?

Summary

US equities have delivered excellent returns and enthusiastically greeted Trump but in 2025 I believe they will take a breather, and better returns may be available elsewhere. I have almost equal allocation to equities and bonds but with a preference for Europe over the US. I am concerned about US inflation, and in my portfolio have gold and CHF as a hedge. Bitcoin would also be a good hedge for those who could stomach its volatility. I am cautious on hard and soft commodities for geopolitical reasons.

This view is driven by three important observations:

US equities are very expensive, especially in certain sectors such as IT. What makes the situation critical now is already high margins, which means earnings are unlikely to grow as fast as before, while valuation multiples are already extreme.

US debt is unsustainable. The federal budget deficit is high and likely to grow further, and the most likely way out is through inflation. Tariffs and immigration controls could contribute to inflation. In combination with signs of a cooling US economy, this could mean stagflation.

The conflicts in the Middle East and in Ukraine are likely to be resolved quickly under Trump. This will remove supply restrictions on a range of important commodities with a negative impact on price, making them unsuitable as a US inflation hedge. I prefer gold and CHF. At the same time lower energy costs could spark European equities into action while contributing to lower EU inflation.

US equities are expensive

Even before their enthusiastic reaction to Trump, US equities have rarely before been more expensive vs bonds. According to a recent report by UBS[1], Equity Risk Premium (ERP), the excess return that investors demand from stocks over the risk-free rate, was at the 15th percentile of a 100-year distribution.

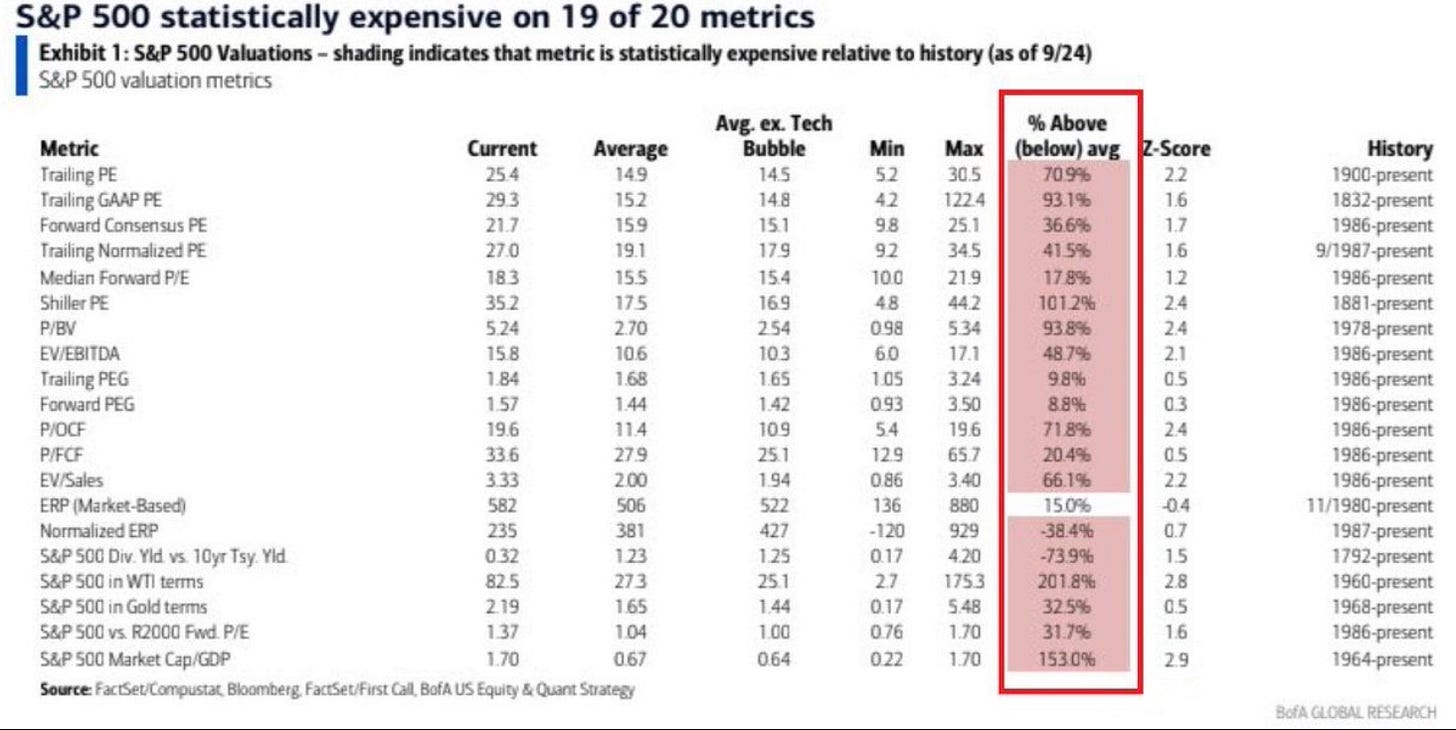

US equities were not just expensive vs bonds as the extremely low ERP shows, but also expensive vs their own history practically on any metric. In particular, they were over 100% more expensive on an important Schiller P/E metric, according to the BoA Quant team [2]. This metric considers earnings over the full business cycle, for example, to account for the fact that margins today are high, which artificially lowers P/E by inflating earnings.

One could argue that the S&P500 deserves a higher multiple because of the larger proportion of the index taken by technology companies, which trade at a premium. However, each individual sector is also extremely expensive. As of Nov 1, all sectors of S&P500 except energy were overvalued vs their own history on P/E[3]. IT was particularly expensive. I have my own concerns about the Energy sector.

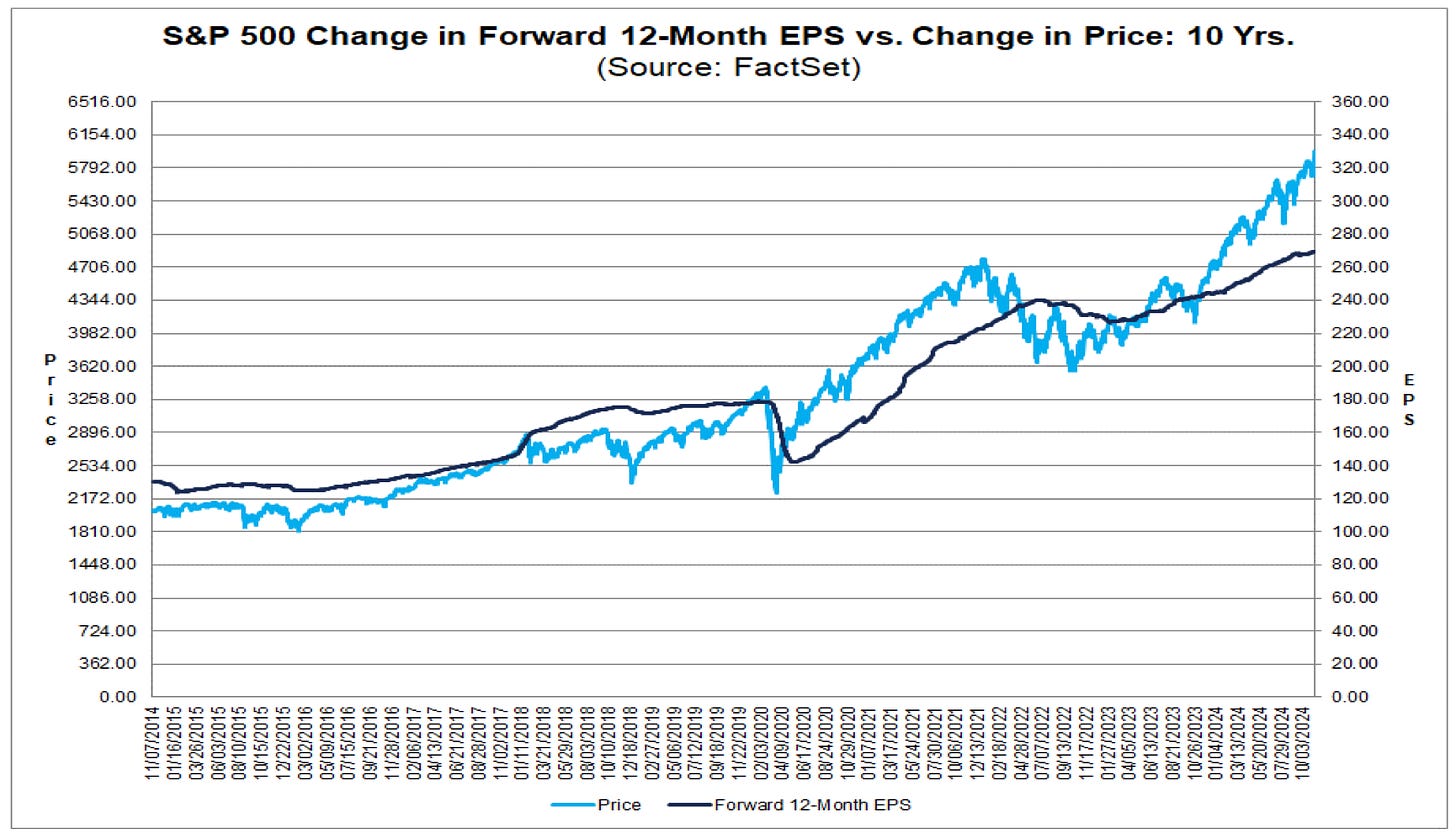

Another argument sometimes used to justify high valuation is that the adoption of AI should lead to such productivity gains that margins would move higher. In this case, P/E multiple, where margins are in the denominator, should be depressed. In fact, bar the short-term falls and rises, over the last 10 years S&P500 EPS has been on a straight-line trajectory equivalent to just under 10% annual growth but the price action on S&P500 is by far overshooting this trajectory over the last 2 years[4].

If AI will lead to future growth in margins, this should be reflected in increasing bottom-up EPS growth forecasts for S&P 500. But for CY 2024, analysts are again projecting earnings growth of 9.4% and revenue growth of 5.1%. This indicates an expectation for margin expansion. However, the reported earnings growth in Q3 2024 was 5.3% with 5.5% growth in revenue, which means actual margin contraction. For Q4, analysts are projecting EPS growth of 12.2% and 14.8% for CY 2025. We will see what the earnings growth will be, but for now this high growth expectations are baked into the 12 months forward S&P500 P/E of 22.2 which is above the 10-year average of 18.1.

US corporate earnings are likely to slow

Equity market performance is driven either by the valuation multiple expansion, as in the case of the current bull market, or growth in profits. However, corporate profits are already high. The above-mentioned UBS report[5] calculates that the corporate profits vs GDP today are at the 95% percentile. This points to limited margin upside from here and in the best case, mediocre equity returns in the US, but in the worst case a US equity market sell-off.

Typically, high valuations by themselves do not necessarily lead to a sell off. However, during a recession this is almost guaranteed to happen. To be clear, I do not forecast a recession in the US but there are signs of cooling. Specifically, we point to slowing employment; rising credit card, auto and commercial real estate loans delinquencies; falling manufacturing PMI new orders and weak capex intentions, according to BCA[6].

I prefer less expensive US stocks, that benefit from exposure to attractive investment themes that would ensure earnings growth over the long term, such as security. I like exposure to less expensive factor biases, such as high dividend yield, which I also like for income. I try to avoid over-hyped technology market darlings. Most of all, I think it is time to look for equity exposure outside the US.

High US federal deficit leaves little room for fiscal stimulus

The market expects further tax cuts from the Trump administration. Yet the federal budget deficit of 7%, which is high for an economy close to full employment, leaves very little room for fiscal stimulus. Instead, perhaps the previous Trump tax cuts worth $390bn[7] should have expired and additional increases in individual and corporate taxes would have been needed to reduce the budget deficit.

There is an opportunity to reduce spending. Elon Musk is reportedly ready for the job of the Government “chief efficiency officer” and has been warning voters to prepare for economic “hardship”[8] . This is not going to be easy and will take time. I would like to witness his progress before changing my view.

One particular item of $1.1trln[9], which is already larger than the Defence and Medicare spending, is likely to grow even further driving the budget deficit higher. This item is the net interest to service the debt. With rising yields on longer dated US borrowing[10] and the large amount of debt with low interest rates, which will need to be refinanced at a significantly higher rate, this may be hard even for the mighty Elon Musk to rein in.

Escalating national debt is becoming an issue for US fixed income.

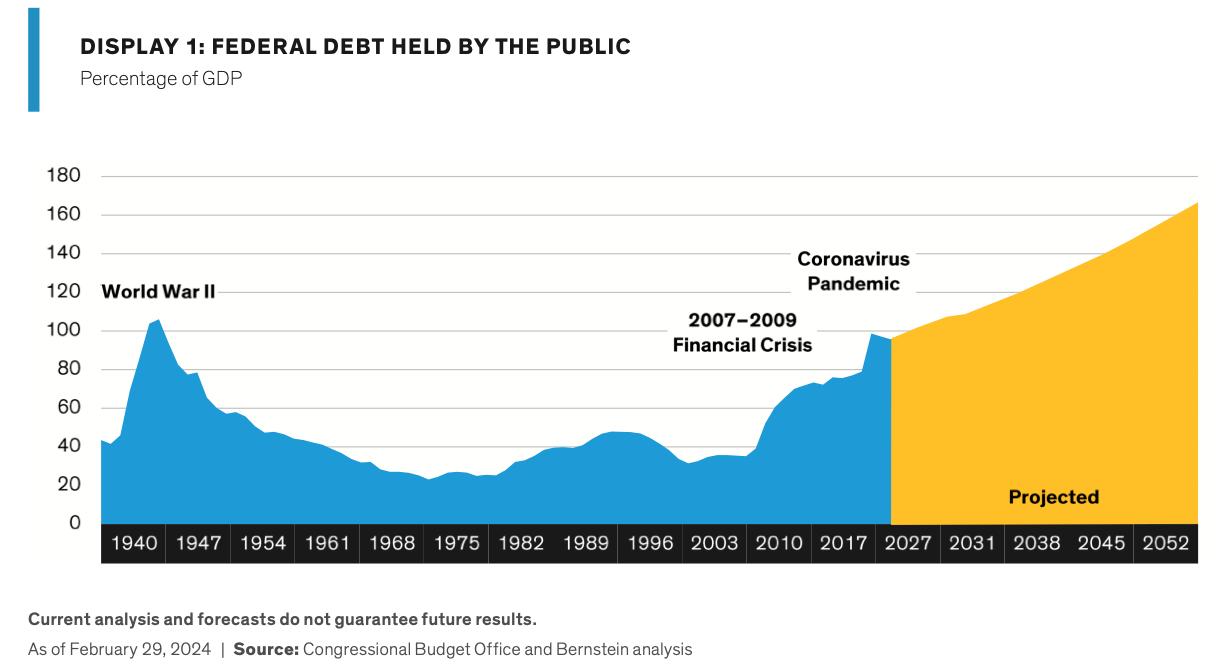

The US national debt is now $36trln[11], including $28.57trln[12] in debt held by the public, which is 97% of GDP of $29.35trln as of 3Q24[13]. The ratio was only higher after WWII at 106%. This debt almost tripled in absolute terms and doubled as a percentage of GDP in the decade after the great financial crisis as the budget deficit was consistently high in comparison to the achieved GDP growth.

For example, between 2012 and 2019, debt rose, on average, by nearly 6pp annually (compared with nominal GDP growth of about 4%) and at the end of 2019, federal debt held by the public was equal to 79.2% of GDP[14]. Following the pandemic debt increased further, exceeding previous forecasts by the Congressional Budget Office (CBO)[15]. Now analysts[16] forecast further growth to above 150% of GDP over the next 30 years.

The escalating US national debt will most likely be resolved by inflation, in my view. Tariffs and immigration controls may further contribute to inflation. The ideal way out of the debt spiral would have been to grow the economy faster than the budget deficit. Unfortunately, this is unlikely given the wide deficit in combination with already high US corporate profits and signs of cooling discussed above.

This means the most likely outcome will be inflation, which would make longer-term bonds unattractive in the US. The Fed will have a difficult balancing act controlling inflation yet reducing the interest rates. The fact that the 10-year US bond yields rose after the Fed implemented their most recent 50bps cut, may indicate that the bond market is already worried about inflation.

US corporate credit seems to be equally sending mixed signals. For example, according to BCA[17], high-yield spreads have dropped 60 bps since February 2022 even though the trailing 12-month default rate in the US has risen to 5.4% from a low of 1.2% during this period.

The dollar is facing some headwinds due to geopolitics

US has been in the privileged position because USD is the world’s reserve currency of choice, and its debt obligations are considered almost risk-free. This means that every time US needs to refinance its debt, there are plenty of willing buyers. Foreigners and central banks own about half of the US treasury debt[18].

This may be changing. The proportion of central bank reserves kept in USD has fallen to 59% from its peak of 73% in 2001 according to IMF data[19]. China, in particular, has also been making a significant effort to reduce the USD share in invoicing for cross-border trade, which it views as one of its biggest vulnerabilities[20]. Weaponisation of the dollar by its use as a sanctions mechanism, may have contributed to this move.

At the last BRICS summit held in October 2024, a solution was proposed in the form of a “BRICS Bridge”. The expanded BRICS club now has 10 country members with 3.3bn people and GDP at PPP larger than G7[21]. The system will be built within a year allowing participant countries to conduct cross-border settlements using a digital platform run by their central banks, without the need to use USD or the corresponding banks in the US. To add to the attraction, the use of digital money should make this system cheaper and faster.

Of course, this is a relatively long-term trend but, in the meanwhile, the dollar has exuberantly greeted the Trump victory in expectation of more tariffs and over the near-term it could continue to move up. However, I find it difficult to comprehend why would the currency of a country with inflation, spiralling national debt, widening budget deficit and signs of cooling economy would strengthen, even in the near-term.

We prefer Eurozone exposure in EUR

Given my concerns around debt, valuations and corporate growth in the US, at this point I prefer fixed income and equities by the Eurozone issuers in EUR.

In contrast to the US, Eurozone overall has been making efforts to reduce its budget deficit, which similarly to the US ballooned during the great financial crisis (GFC) and then again during COVID-19. In the Eurozone, GFC was followed by recession with rapid increase in debt/GDP ratios, which led to the sovereign debt crisis, when several Eurozone member states such as Greece, Ireland and Portugal were unable to service their debt, nor devalue their common currency.

The onset of the debt crisis was in late 2009 when the Greek government disclosed a far higher budget deficit than expected[22]. The Greek government debt to GDP just before the recession was hovering near 100%, similarly to what it is now in the US, but then it rapidly increased to above 180% by 2011. By then, the debt of Italy, Ireland and Portugal were also above 100%. Then EU legislation was strengthened around The Stability and Growth Pact (SGP), requiring a fiscal cap of 3% of GDP and public debt target of 60%[23]. The decade of austerity followed which was associated with slower growth and weaker employment than in the US.

Today, EU countries are forced to take measures when their debt and deficit are on an unsustainable path. For example, France’s new Government led by the experienced “Mr Brexit” Michel Barnier has just proposed major tax increases and spending cuts to bring their 6.1% budget deficit to the 3% EU target by 2029[24]. Even the UK, which is not part of the EU anymore, has just announced one of the largest tax increases in its history to plug the budget deficit, but unfortunately it was matched by even larger spending plans.

One important difference with the US, however, is that it can chose to devalue the dollar rather than go through years of austerity. President Trump is also very clear in his desire for weak dollar. This is why weak USD remains my main scenario, which in combination with slowing growth, could lead to stagflation in the US.

In contrast, the EU has already gone through the years of austerity and its debt is now on a sustainable path. European consumers, unlike those in the US, have plenty of excess savings[25]. European industry still remains depressed with its high energy costs relative to the US, but in my opinion even this situation may soon improve due to geopolitics.

European equities trade at a discount to the US, which is justified by weaker growth and is typical. However, this discount has grown significantly more than warranted over the last years, in my opinion. Importantly, they are also much cheaper vs their own history. Lower energy costs with the end of geopolitical conflicts could be the catalyst that would propel the European equity market into action.

Chinese equities could be an interesting bet

Other interesting opportunities may be found in China[26], which is trading at a large discount to own history. The risk of additional tariffs, primarily aimed at China, of course makes me cautious. However, the Chinese Government is maybe at the point to provide some stimulus. On November 8, China announced a Rmb10trln ($1.4trln) fiscal package aimed to help local governments to restructure their finances[27]. More stimulus may come in response to additional US tariffs. I therefore maintain some exposure.

Additional stimulus aimed at Chinese consumers, would be also beneficial for the European luxury products. The European luxury sector has particularly underperformed recently on weak Chinese demand[28]. This could offer another interesting bet.

Resolution of the geopolitical conflicts could hit commodity prices

With the election of Trump, the two important geopolitical conflicts are approaching their resolution, in my opinion, which would remove supply restrictions on a range of important commodities. Without a simultaneous increase in demand, this would lead to falling prices, which is why I am not suggesting commodities as an inflation hedge.

Oil prices are spiking with every escalation in the Middle East. This is because of the potential threat to the oil extraction, refining and transport, importantly including the oil and petroleum products transit though the Strait of Hormuz, the world’s most important route through which flow around 20mbpd[29].

I feel optimistic. Firstly, I believe that both Israel and Iran have been restraining their direct attacks on each other. This gives me hope that the Middle East is on the path to de-escalation. Secondly, the new US administration is likely to push for the resolution of this conflict. President Trump is a businessman who prefers the “Art of The Deal” to war mongering. He said he wants peace for the Middle East. The conclusion of this conflict would remove the supply constraints on oil. In addition, Trump is a big supporter of US shale, which would further add to supply.

Similarly, Trump will push for the resolution of the conflict in Ukraine. He repeatedly said that he can end it within 24hrs. While I doubt it is possible that fast, I believe US will now provide a forceful push towards a negotiated solution. Moreover, the accelerating recent Russian army advances[30] will force Ukraine to moderate its negotiating position.

On the other hand, I think that the Russian economy is stretching itself, as illustrated by the total state spending on defence and security of almost 41% of total expenditure or 8% of the country's GDP[31]. This by itself, may not be sufficient because most of this spending goes to domestic industry, witness Russia’s 3.6% GDP growth in 2023[32] and the recent quarters above 4%.

However, I believe that Russia would be willing to halt their advances in exchange for the removal of the international sanctions. Therefore, the negotiated peace would likely come with easing of sanctions on a wide range of hard and soft commodities from Russia. Ukraine is also a big supplier of many commodities where the infrastructure or supply routes are currently under threat.

The removal of sanctions on oil, gas and industrial metals very much aligns with the European interests, and especially Germany, which is keen to lower energy prices as a way to make its industry more competitive again. Italy is another country which heavily relied on Russian gas previously and therefore would likely benefit disproportionally. Cheaper energy would feed through lower costs for business and consumers thus lowering inflation and boosting the economy.

Lower commodity prices could be an important catalyst for Europe, where I would build exposure. Conversely, because of the likely increase in supply and hence falling prices, I dislike commodities that would typically be a good hedge against inflation. Instead, I own gold and CHF as an inflation hedge.

Bitcoin would also be a good hedge for those who could stomach its volatility. President Trump and Elon Musk are both enthusiastic supporters of crypto. Regardless, I see more signs of institutionalisation of digital currencies with more crypto-linked ETFs from traditional institutional money managers.

Important disclaimer

This article is provided for information purposes only. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment advisor.

[1] Source: https://www.morningstar.com/news/marketwatch/20241030218/stocks-have-rarely-been-this-expensive-versus-bonds-now-ubs-expects-that-to-change

[2] Source: https://www.linkedin.com/posts/charles-henry-monchau-cfa-cmt-caia-4003096_this-is-one-of-the-most-overvalued-markets-activity-7257609762484240385-jFTB?utm_source=share&utm_medium=member_ios

[3] Source: Source: https://worldperatio.com/sp-500-sectors/

[4] Source: https://advantage.factset.com/hubfs/Website/Resources%20Section/Research%20Desk/Earnings%20Insight/EarningsInsight_110824.pdf

[5] Source: https://www.marketwatch.com/story/stocks-have-rarely-been-this-expensive-versus-bonds-now-ubs-expects-that-to-change-24a76869

[6] Source: BCA Research, global investment strategy, “Fourth Quarter 2024 Strategy Outlook: Soft Landing or Quicksand?”, September 2024

[7] Source: https://www.cnbc.com/video/2024/10/22/paul-tudor-jones-we-are-going-to-be-broke-really-quickly-unless-we-get-serious-about-our-spending.html

[8] Source: https://www.nbcnews.com/business/economy/economy-if-trump-wins-second-term-could-mean-hardship-for-americans-rcna177807

[9] Source: https://fiscaldata.treasury.gov/americas-finance-guide/national-debt/#:~:text=Maintaining%20the%20National%20Debt&text=As%20of%20September%202024%20it,spending%20in%20fiscal%20year%202024.

[10] Source: https://www.reuters.com/markets/us/yields-soar-trump-win-stirs-bond-vigilantes-2024-11-06/

[11] Source: https://fiscaldata.treasury.gov/americas-finance-guide/national-debt/

[12] Source: https://fiscaldata.treasury.gov/datasets/debt-to-the-penny/debt-to-the-penny

[13] Source: https://fiscaldata.treasury.gov/datasets/debt-to-the-penny/debt-to-the-penny

[14] https://www.cbo.gov/system/files/2020-03/56165-CBO-debt-primer.pdf

[15] Source: https://www.cbo.gov/publication/56309#_idTextAnchor048

[16] Source: https://www.alliancebernstein.com/content/dam/global/insights/insights-whitepapers/the-us-national-debt-debt-or-alive.pdf

[17] Source: BCA Research, global investment strategy, “Fourth Quarter 2024 Strategy Outlook: Soft Landing or Quicksand?”, September 28, 2024

[18] Source: https://www.alliancebernstein.com/content/dam/global/insights/insights-whitepapers/the-us-national-debt-debt-or-alive.pdf

[19] Source: The Economist, Special report “The Dollar”, October 14, 2024

[20] Source: The Economist, “Putin’s plan to dethrone the dollar”, October 20, 2024

[21] Source: https://www.europarl.europa.eu/RegData/etudes/BRIE/2024/760368/EPRS_BRI(2024)760368_EN.pdf

[22] Copelovitch, Mark; Frieden, Jeffry; Walter, Stefanie (14 March 2016). "The Political Economy of the Euro Crisis". Comparative Political Studies. 49 (7): 811–840. doi:10.1177/0010414016633227. ISSN 0010-4140. S2CID 18181290.

[23] https://www.intereconomics.eu/contents/year/2022/number/1/article/eu-fiscal-rules-a-look-back-and-the-way-forward.html

[24] https://www.reuters.com/world/europe/french-government-present-2025-belt-tightening-budget-2024-10-10/

[25] Source: BCA Research, global investment strategy, “Fourth Quarter 2024 Strategy Outlook: Soft Landing or Quicksand?”, September 28, 2024

[26] Source: Source: https://worldperatio.com

[27] Source: https://www.ft.com/content/97501755-4cbe-4ce8-8b05-b0e10cbbb866#post-1e807cf4-7ef9-48da-89d8-d17f2907c2f0

[28] Source: https://www.bloomberg.com/news/articles/2024-10-16/lvmh-plunges-as-chinese-luxury-spending-slowdown-worsens

[29] Source: https://www.eia.gov/todayinenergy/detail.php?id=61002#

[30] Source:

https://deepstatemap.live/#6/49.4383200/32.0526800

[31] Source: https://www.reuters.com/world/europe/russia-hikes-national-defence-spending-by-23-2025-2024-09-30/

[32] Source: https://data.worldbank.org/indicator/NY.GDP.MKTP.KD.ZG?locations=RU

I dont recommend individual stocks here but if you are looking for inspiration for investable ideas, I recommend Alex's well-researched ideas on https://sweetstocks.substack.com and for Asia https://www.asiancenturystocks.com. I like global small cap and value factor biases.

Given the uncertainty and high consequence events associated with Trump's tariff policies, challenging fiscal situation the US faces while it's main financiers are reducing their exposure and attempting to reduce the unfair exorbitant privilege the US (dollar) enjoys, why not just do nothing and hold a big pile of cash rather than invest? The US and many markets are pretty long into this bull market and likely closer to the top than bottom.