The recent escalation in the Israel-Iran conflict has sharpened investor focus on the relationship between oil prices and financial markets. While the typical 'risk-off' response—favouring bonds and pressuring equities—is well understood during periods of geopolitical tension, the implications of rising oil prices are more nuanced.

Moreover, most economists speak in unison about their overwhelming belief that Trump’s “Liberation Day” tariffs would increase US inflation. Consequently, most market participants have an extremely negative view on US treasuries.

Could it be that the prevailing wisdom of the majority yet again opened an opportunity for a profitable contrarian trade?

In November 2024, in the midst of the Trump trade and US dollar rally we had a good contrarian call with a preference for all European over US assets, including EUR, CHF and gold, and a negative view on US equities and USD.

Then, having well profited from this trade, in the midst of the investor panic in early April following the “Liberation” day, we again had a contrarian call in our well-read article “Why penguins need an F-16”, saying that the tariffs make us more, not less positive on US assets. Accordingly, we made small changes to our portfolios.

In this particular call, we argued that the “tariffs” are nothing but a strongly-worded invitation to a negotiating table on a whole range of geoeconomic issues. They are unlikely to be implemented as presented, and the US likely will extract various economic benefits during those negotiations.

So far this call been correct, as most of the countries fell in line to negotiate and most of the tariffs are on hold waiting for the conclusion of the negotiations. Since the “Liberation Day” S&P is up +6.2%.

Inflation impact of tariffs so far has been negligible

The Fed’s personal consumption expenditure (PCE) inflation data released on May 30th, shows that that widely expected inflationary impact was largely absent and seasonally adjusted goods prices rose by just 0.1%. Another measure of inflation, Consumer Price Index (CPI), at 2.4% in May also remained relatively low.

Source: Federal Reserve Bank of St. Louis

Same picture on the producer side, where Producer Price Index (PPI) also increased by only 0.1% in May, which was below expectations.

Energy’s impact on inflation is larger than tariff’s

This may not be that strange. A recent paper from the Boston Fed “ The Impact of Tariffs on Inflation” estimates that imports account for only 10% of core PCE, including 6% direct and 4% indirect impact.

While energy Inflation in the US directly accounts for more than 9% of the CPI. This represents the proportion of energy costs within the overall basket of goods and services used to calculate inflation.

In addition, energy is a significant input for many other products and services, meaning that changes in energy prices can indirectly affect a wider range of goods and services.

Finally, the US is the largest producer of oil in the world, pumping over 13.5 million barrels per day, employing millions of workers and generating trillions of dollars annually. This means that weaker oil price has negative impact on US employment, and hence on demand-pull inflation.

Therefore, the combined direct and indirect effects of energy on US inflation are likely to exceed those of tariffs. As a result, oil prices represent a more critical variable in assessing the probability of forthcoming Fed rate cuts.

Direction of oil price is key for treasuries

In May US energy prices fell by 3.5% year-on-year, following a 3.7% drop in the prior month, marking the fourth consecutive month of decreases at a solid pace. This had a strong taming impact on inflation.

However, this is likely to reverse if the Israel-Iran conflict escalates. Brent price has initially jumped over 10% since the beginning of the hostilities, and if the flow of oil and gas through Strait of Hormuz is reduced, oil is likely to go yet higher, possibly over $100.

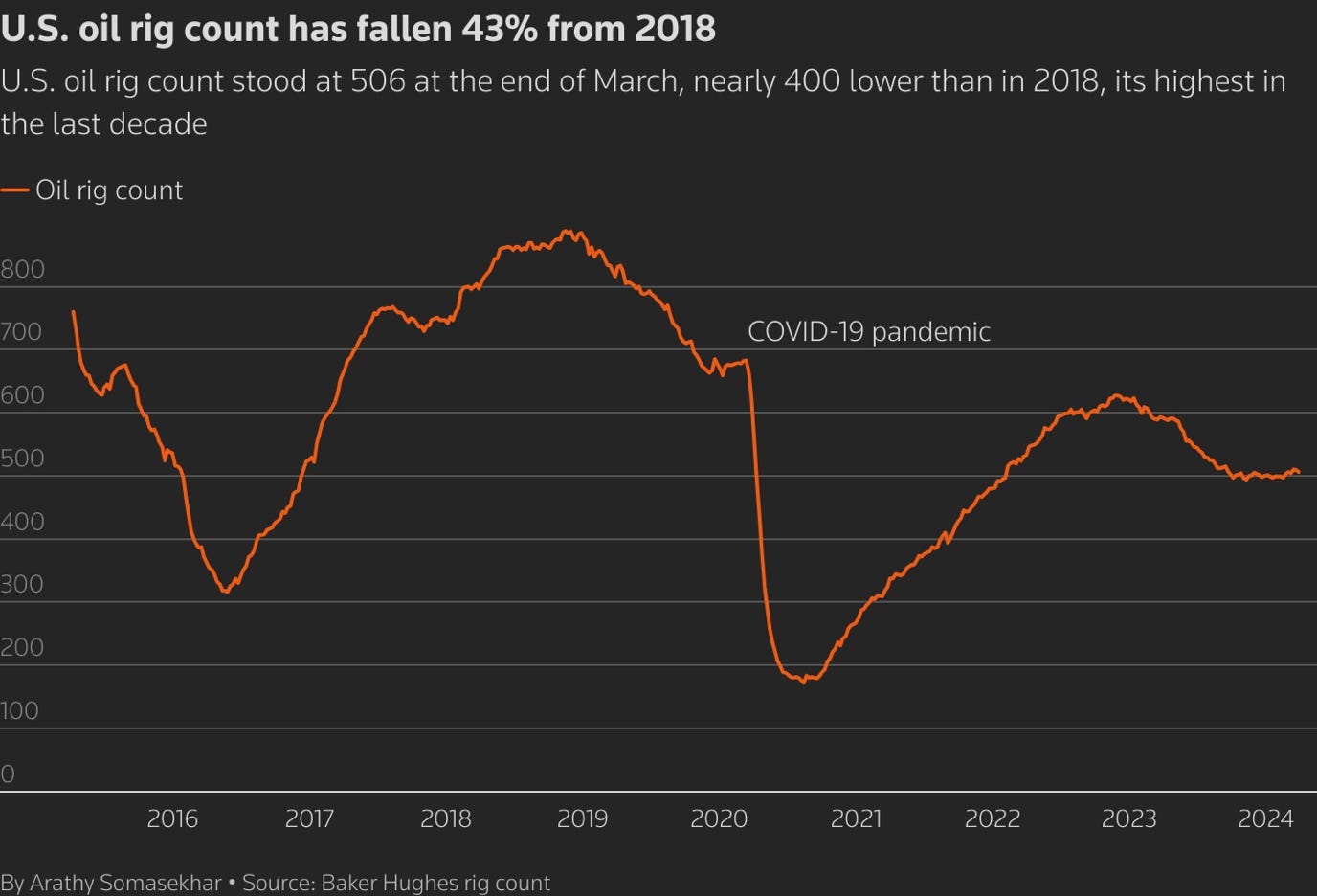

But if the oil price stay at a higher level, that would encourage more drilling in the US. As of end of March, the US rig count stood at 506, some 10% below the recent peak in 2023 and 43% below all-time high in 2018.

Source: Reuters

US oil producers need a price of $65 per barrel on average to profitably drill, according to a Dallas Fed survey. Average break-evens, or the cost of developing a new well, were just under $48 a barrel, according to research firm Rystad Energy and Wood Mackenzie. Break-even rises to over $60 a barrel once dividend payments, debt repayments, corporate expenses and other costs are included.

Therefore, higher oil price would increase production which will ultimately reduce price through extra supply. Trump’s “Drill Baby Drill” only encourages this dynamic.

Investment conclusion

We are watching the Middle East carefully but believe that oil prices are on a long-term downward trajectory, although short-term volatility is likely. We also believe that energy has bigger impact on US inflation than tariffs. Therefore, we believe that US inflation will stay tame.

With that in mind and considering the yield, we believe that US Treasuries are already attractive. They may, however, become even more attractive after a likely spike in oil price and inflation in June/July, especially if the Israel-Iran conflict intensifies, which could open an even better entry point.

Source: https://www.ustreasuryyieldcurve.com/#google_vignette

Disclosure

My articles represent my personal opinions and are provided for information purposes only. Their content is not intended to be an investment advice, or a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. I use information sources which I believe to be reliable, but their accuracy cannot be guaranteed. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors and, if in doubt, an investor should seek advice from a qualified investment advisor.