Security and Defence bucks another outflow quarter for thematic equity

Analysing Morningstar's Q1’25 fund flows data

Morningstar Q1’25 European funds flow report well illustrates shifting investor preferences since the beginning of the year.

When we published our investment outlook for 2025 six months ago it looked highly contrarian. It was the market honeymoon after the US elections, the “Trump trade” was in full swing and there seem to have been no alternative to US equities.

Instead, we argued that the US equities will take a breather and better returns may be available elsewhere. We suggested equal allocation to equities and bonds but with a preference for Europe over the US.

Fund flows are consistent with our investment outlook

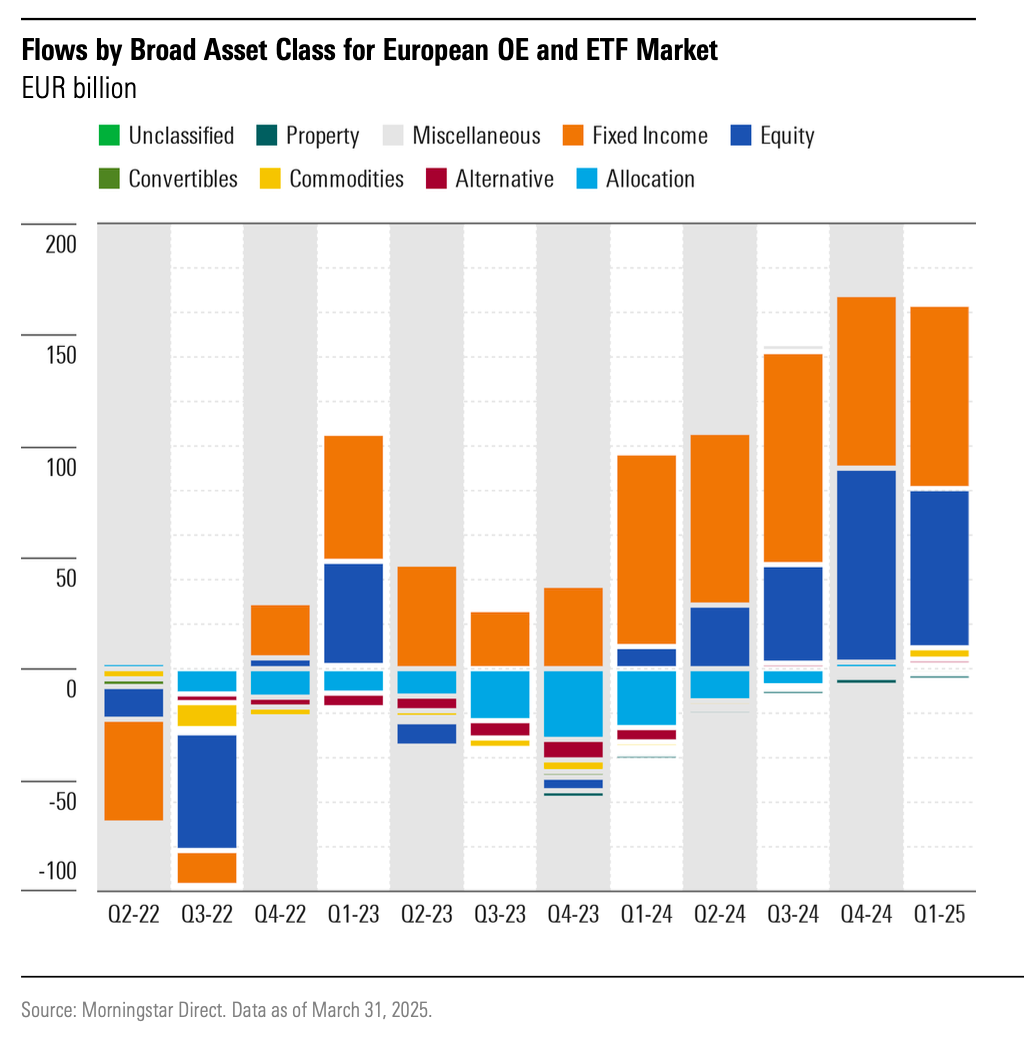

As if following our advice, during Q1’25 investors directed almost equal amount of money into equity and bond funds. In fact, €83bn flows into fixed income was slightly more than half, including €12bn into safer ultra-short term EUR bonds and €4bn into CHF bonds as dollar weakened.

Interestingly, most of these inflows (€74bn) went into actively managed bond funds, in contrast to equity flows, where most of the inflows went into ETFs, with active funds experiencing €7bn of outflows.

Q1 was also the first quarter of outflows from Sustainable funds since 2018 as investor enthusiasm for ESG somewhat vaned.

Since the Trump inauguration and the memorable speech by JD Vance at the Munich Security conference, the Trump trade has clearly started to unwind as February saw the first outflow from US Equities. Instead, European funds dominate money inflows since, which is also one of the reasons of strong outperformance of European equities this year.

Tellingly, Global Equity saw outflows from riskier growth funds and instead inflows into more defensive large-cap blend and equity income funds.

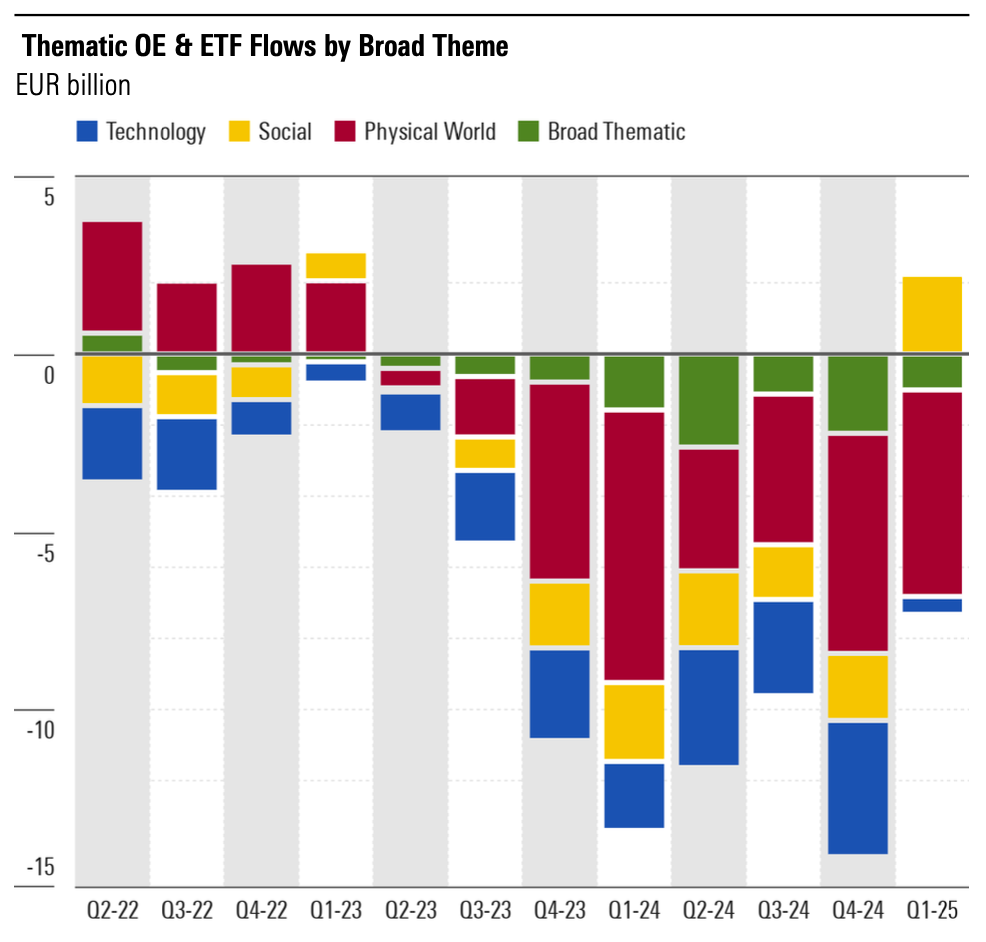

Another outflow quarter from thematic funds

In our article in January we predicted that 2025 was going to be another difficult year for pure thematic equity funds, which could be volatile. To reduce the risk of pure equity thematic, when we launched our thematic portfolio family on 31.12.2024 under the brand One Second West (0°0'1"W) www.001west.com, we made some of them multi-asset, wherever it was possible.

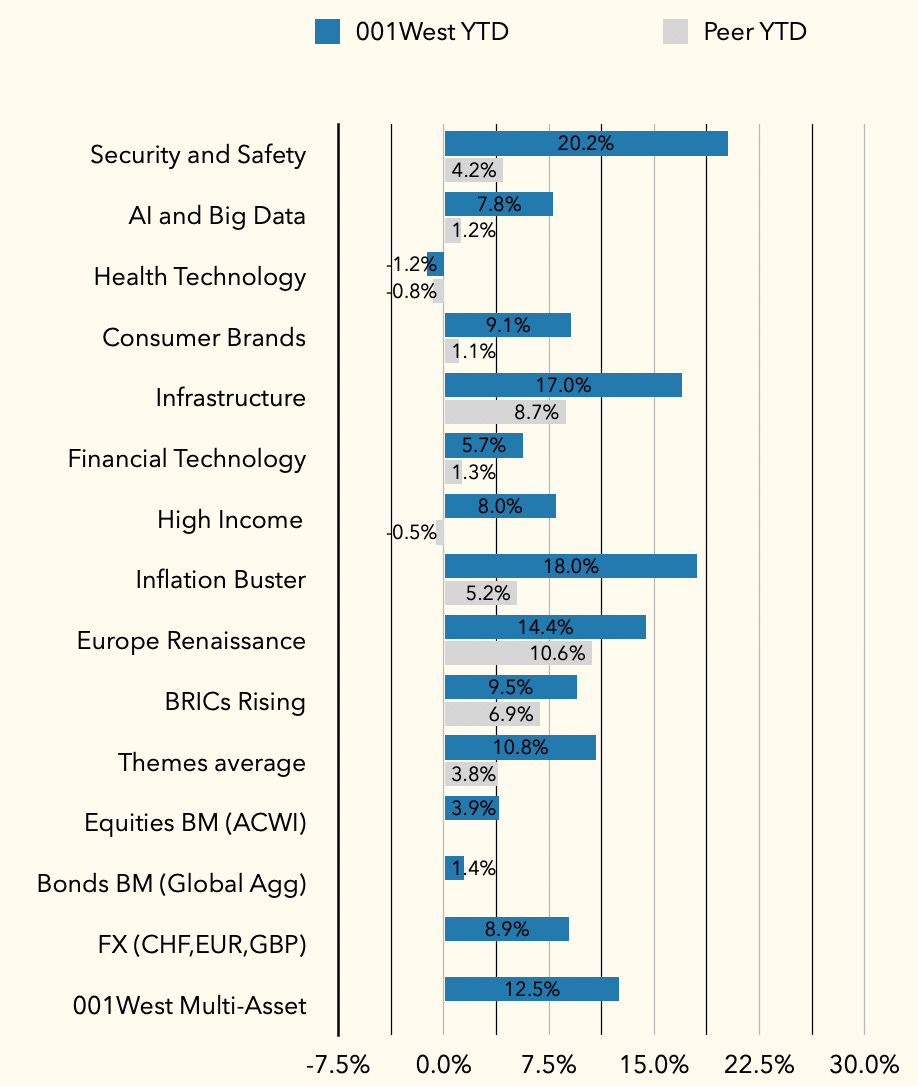

Average year to date return from twenty peer thematic equity funds that we track is +1.4%, which is below +3.9% return from all-countries equity index (MSCI ACWI in USD). In contrast, our 001West thematic average performance is much better at +10.8%, helped by consistently strong performance from our multi-asset thematic portfolios.

Given this poor performance, it is not surprising to see that it was another negative flow quarter for thematic equity, its 8th consecutive quarter of outflows since Q2’23. Overall, thematic equity suffered €72bn in cumulative outflows since June 2023.

“Physical World” themes where Morningstar includes energy transition, food, transportation, and resource management again experienced the largest outflows, consistent with the trend since Q4’23.

Defence and Security theme shines

One notable exception to outflows from thematics were “Social” themes, where Morningstar includes defence alongside demographics, politics, security, and wellness. This category funds gathered €2.2bn inflows during Q1’25.

Investors likely reacted to the news of the proposed €1trln infrastructure and defence spending package in Germany, as well as plans to ramp up defence spending by other European countries. We wrote on this subject separately, arguing that the EU may not afford such as splash.

Interestingly, most of these flows went into passive funds. Two of the biggest Security and Defence funds are the €5.1bn actively-managed Pictet Security (launched in October 2006) and the €3.7bn Van Eck Defense ETF (launched in March 2023). While actively managed Pictet Security lost over €100mln during the first quarter, passive Van Eck Defense ETF gained over €1.5bn inflows.

001W Defence & Security is our best performing thematic portfolio

Since the Morningstar compiled their data we believe the trend of outstanding performance from Security & Defence has only strengthened. Among our thematic portfolio Security & Safety has also become the best performing theme year to date, up +20.2% year to date in USD.

However, our outstanding performance is not representative of our peers, where the four Security thematic equity funds that we track delivered on average +4.2% over the same period. For our peers, we believe Infrastructure, a quasi-equity asset class remains the best performer as well as all themes with heavy European bias, given the significant outperformance of European equities, in general.

As we wrote in our earlier post, investing along the geopolitical themes, such as Security, Defence and Infrastructure is becoming increasingly popular, together with the whole emerging area of Geoeconomics.

Disclosure

My articles represent my personal opinions and are provided for information purposes only. Their content is not intended to be an investment advice, or a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. I use information sources which I believe to be reliable, but their accuracy cannot be guaranteed. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors and, if in doubt, an investor should seek advice from a qualified investment advisor.