August multi-asset and thematic portfolio performance

Our multi-asset portfolio and themes continue their strong performance

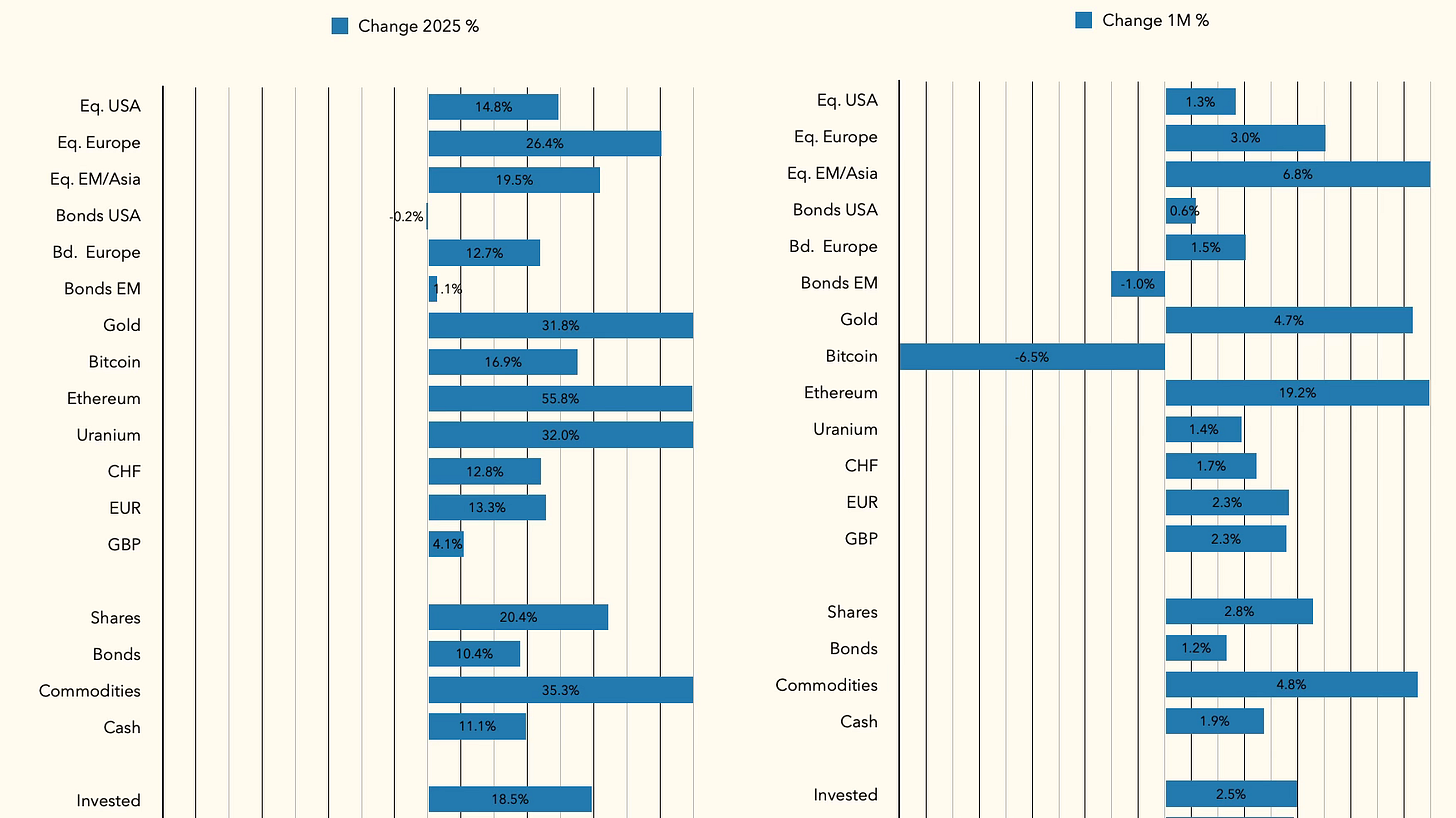

Welcome back from summer holidays! Our multi-asset portfolio delivered 2.5% return in August and 18.5% year to date in USD.

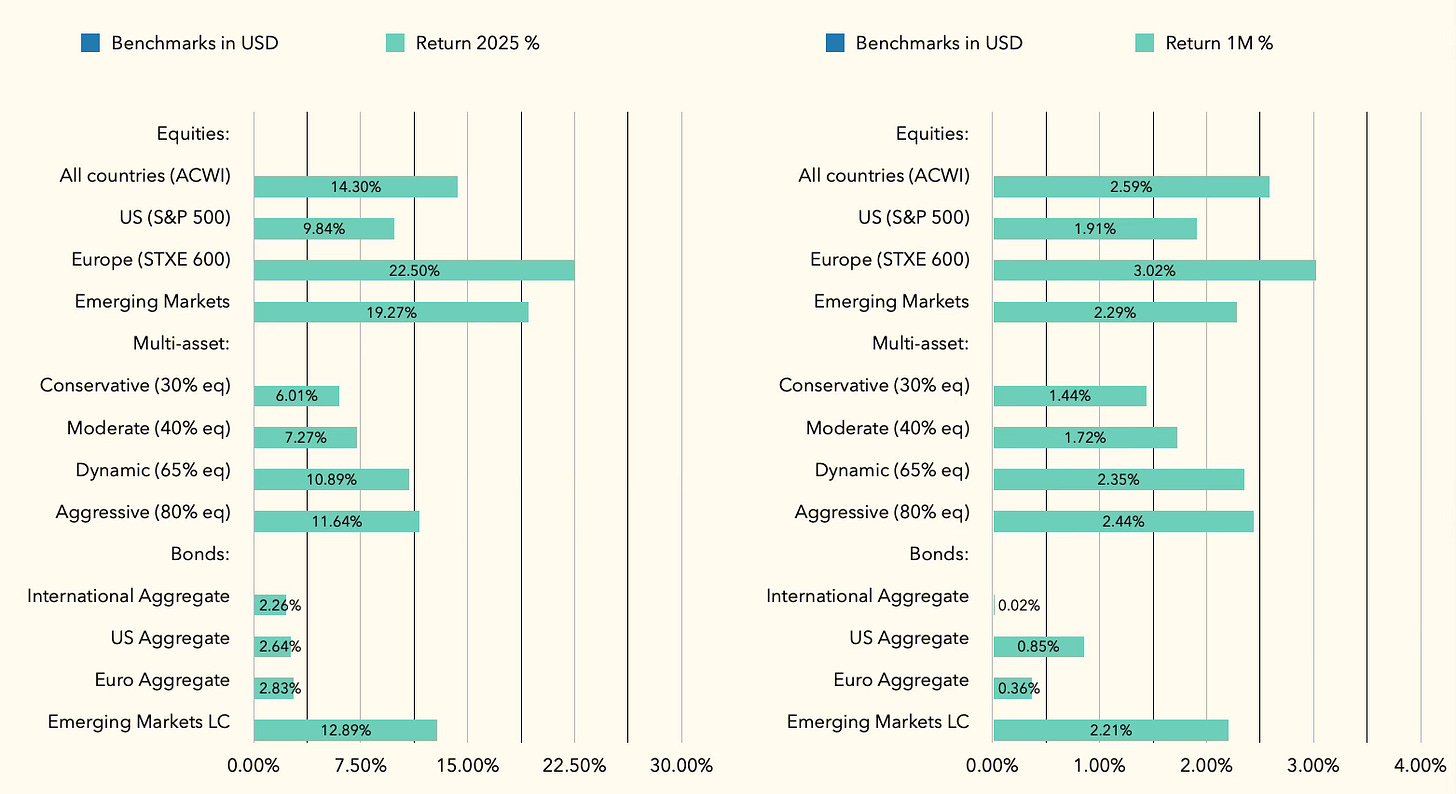

This compares to the 2.6% equities/ <1% bonds return in August and 14.3% equities/ <3% bonds return year to date in USD.

There are several reasons for our outperformance:

Our commodities exposure returning 4.8% in August and 35.3% year to date.

Our overweight Europe and European currencies that outperformed US again in August (reversing the July trend) and year to date

Our better instruments selection i.e. stock/bond picking. For example, our equities are up 2.8%/20.4% vs 2.6%/14.3% for our benchmarks Aug/YTD in USD; and our bonds are up 1.2%/10.4% vs <1%/<3% for our benchmarks.

Commodities is the standout performer asset class for us. Ethereum is up 19.2% in August and 55.8% year to date; Uranium up 1.4% in August for the total of 32% year to date; and Gold is up 4.7% in August and 31.8% year to date. Bitcoin has given up some (-6.5%) of its earlier gains in August but is still up 16.9% year to date.

We don’t have any direct holdings in oil or gas in line with our investment outlook for 2025.

Themes

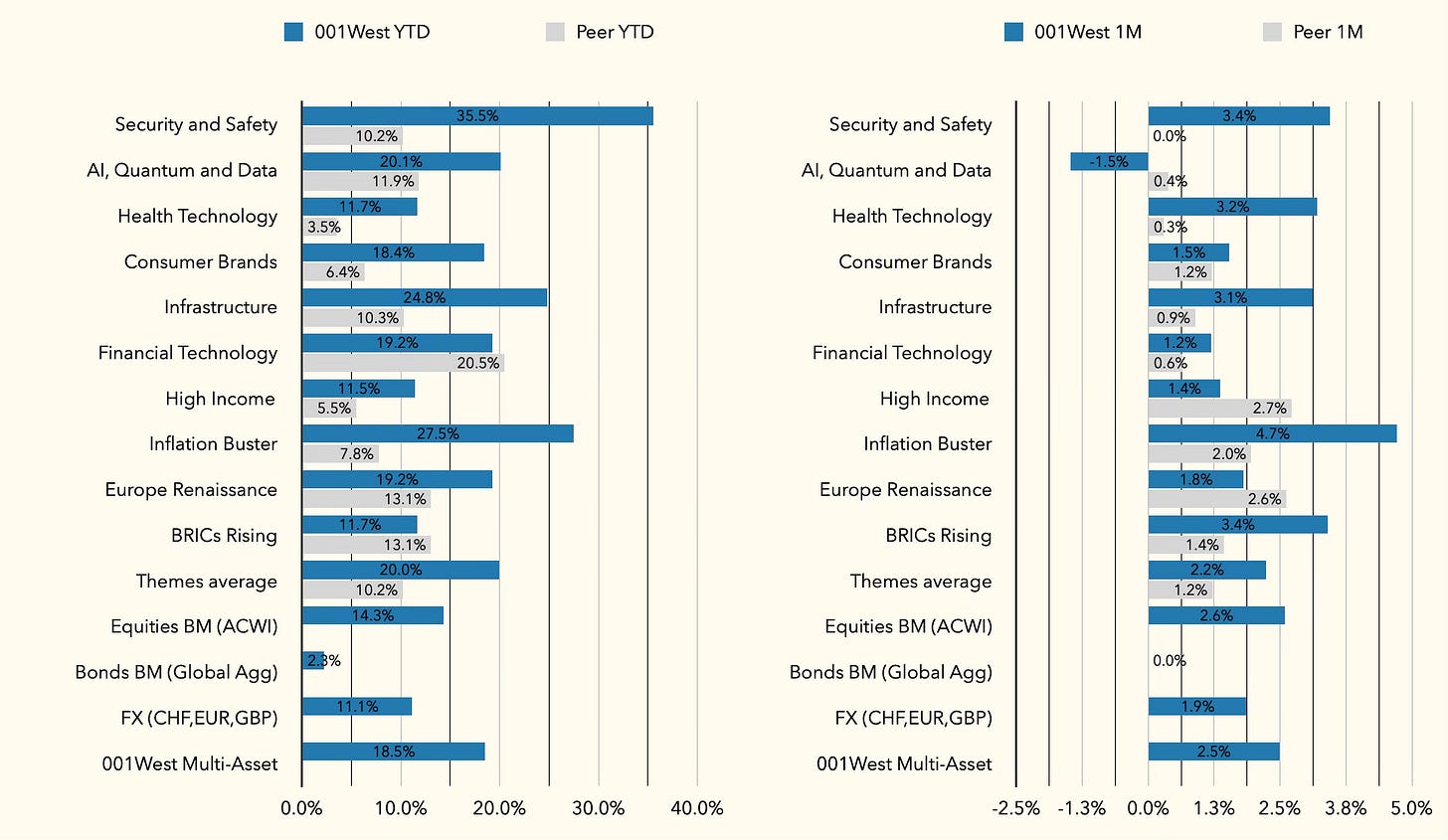

We had another strong month for our unique multi-asset thematics.

The best performer in August was our multi-asset Inflation Buster portfolio that also works well when dollar weakens, see the separate article on the subject. This portfolio is up 27.5% year to date in USD, that is over 3x return of the peers, which is an average of four equity and bond funds that state similar investment objective to beat inflation.

Overall, our best performer year to date is Security and Safety thematic portfolio, up another 3.4% in August for the total of incredible 35.5% year to date in USD! This theme remains particularly relevant in the year of geopolitical tensions and increasing spend on defence among NATO countries. We wrote extensively on the subject.

Infrastructure is another outstanding performer up 3.1% in August and 24.8% year to date. One of the important drivers in this theme is Germany’s significant spent and we have a significant European exposure, see the relevant article.

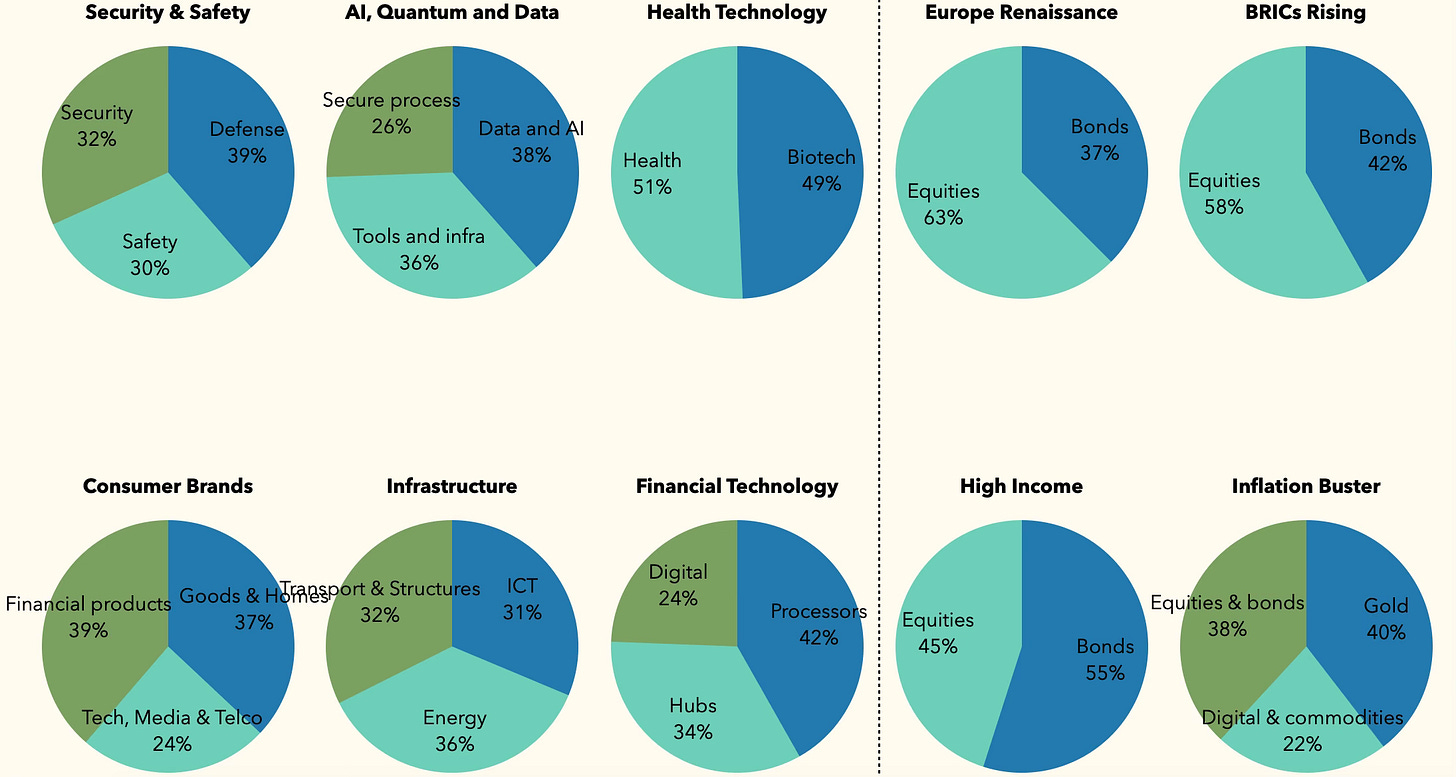

Our Themes on average returned another 2.2% in August for the total of 20% year to date, this is around 2x returns of the peers. Below we show the subtheme exposure for each of our ten thematic portfolios. We have made small changes to the composition, which will disclose in due course.

Disclosure

My articles represent my personal opinions and are provided for information purposes only. Their content is not intended to be an investment advice, or a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. I use information sources which I believe to be reliable, but their accuracy cannot be guaranteed. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors and, if in doubt, an investor should seek advice from a qualified investment advisor.