AI, Quantum and Data theme leads the risk trade resurgence

Analysis of our thematic portfolios performance in May and 2025YTD

In the midst of the investor gloom following the “liberation day” tariff announcement, we were a dissenting voice suggesting that tariffs are a positive development, which makes us less negative on the US (as unlike pretty much everyone else during the Trump rally we were negative on all US assets in our investment outlook 2025 ). We then said that we were making changes to our multi-asset portfolios accordingly.

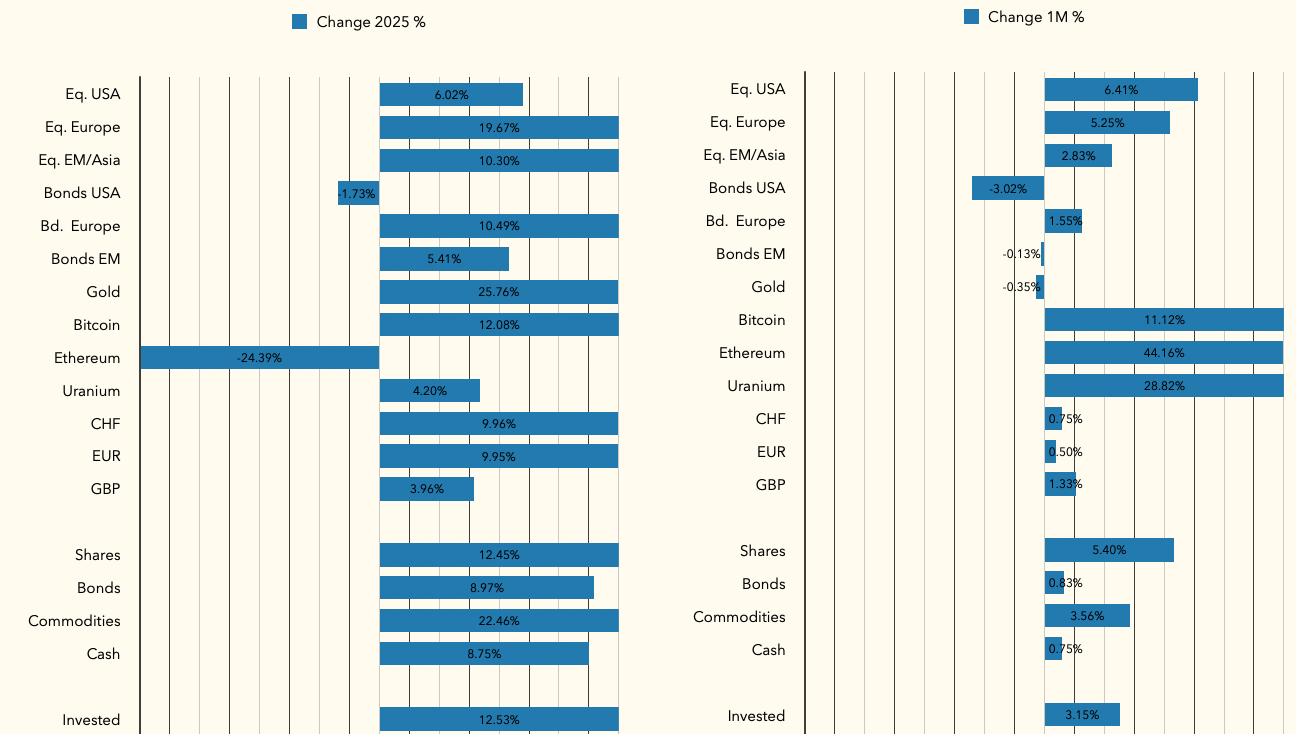

As we expected the rally in US equities and risk assets in general continued. In May, S&P500 was up +6.2% (our US equities selection was better at +6.4%), outperforming European and Emerging markets equities in USD for the first time since the Trump inauguration. The pace of dollar depreciation has also slowed considerably. In our portfolios only crypto and uranium delivered better returns in a typical risk-on trade when speculative assets are up, while the most defensive, such as gold are down.

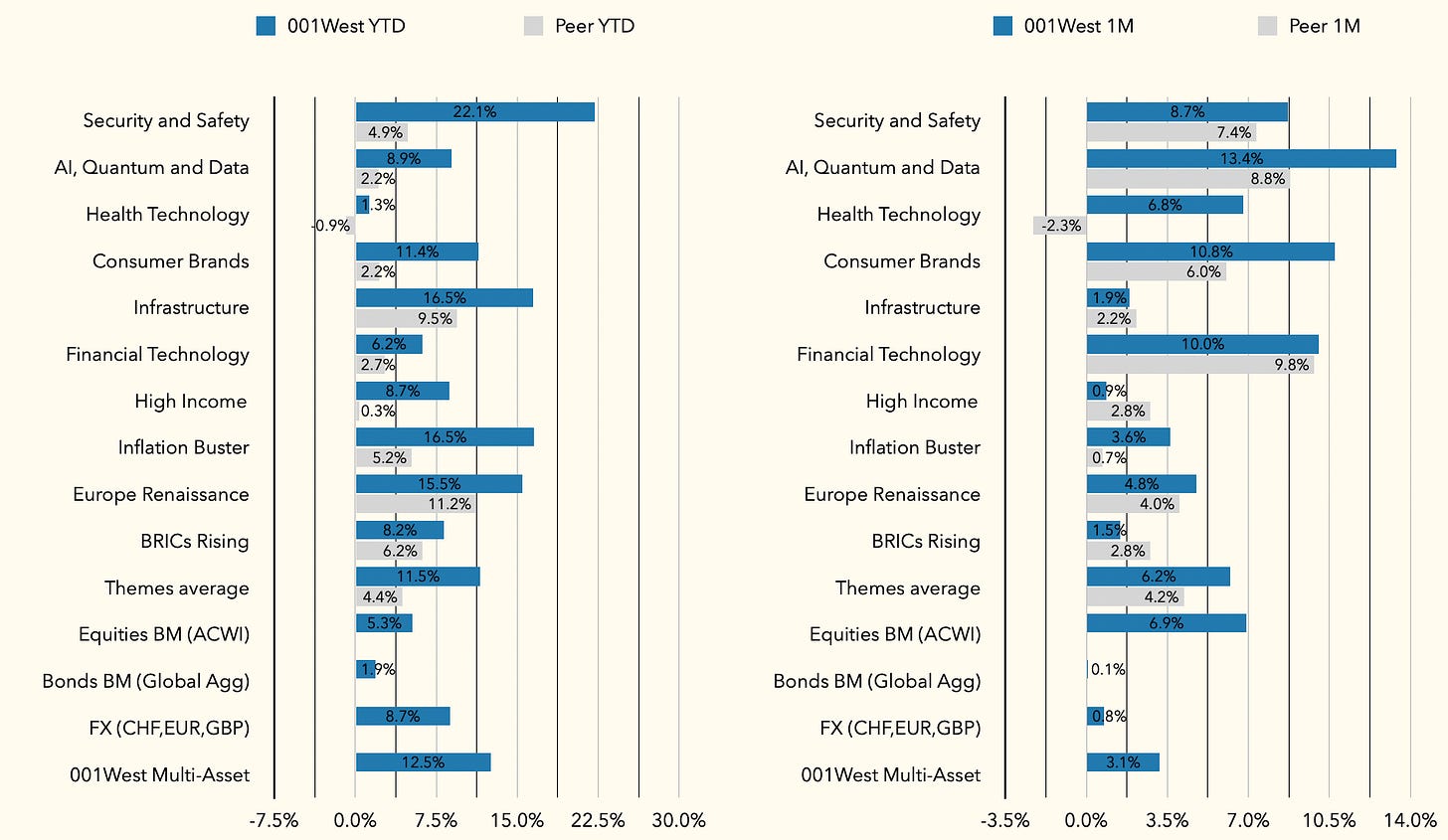

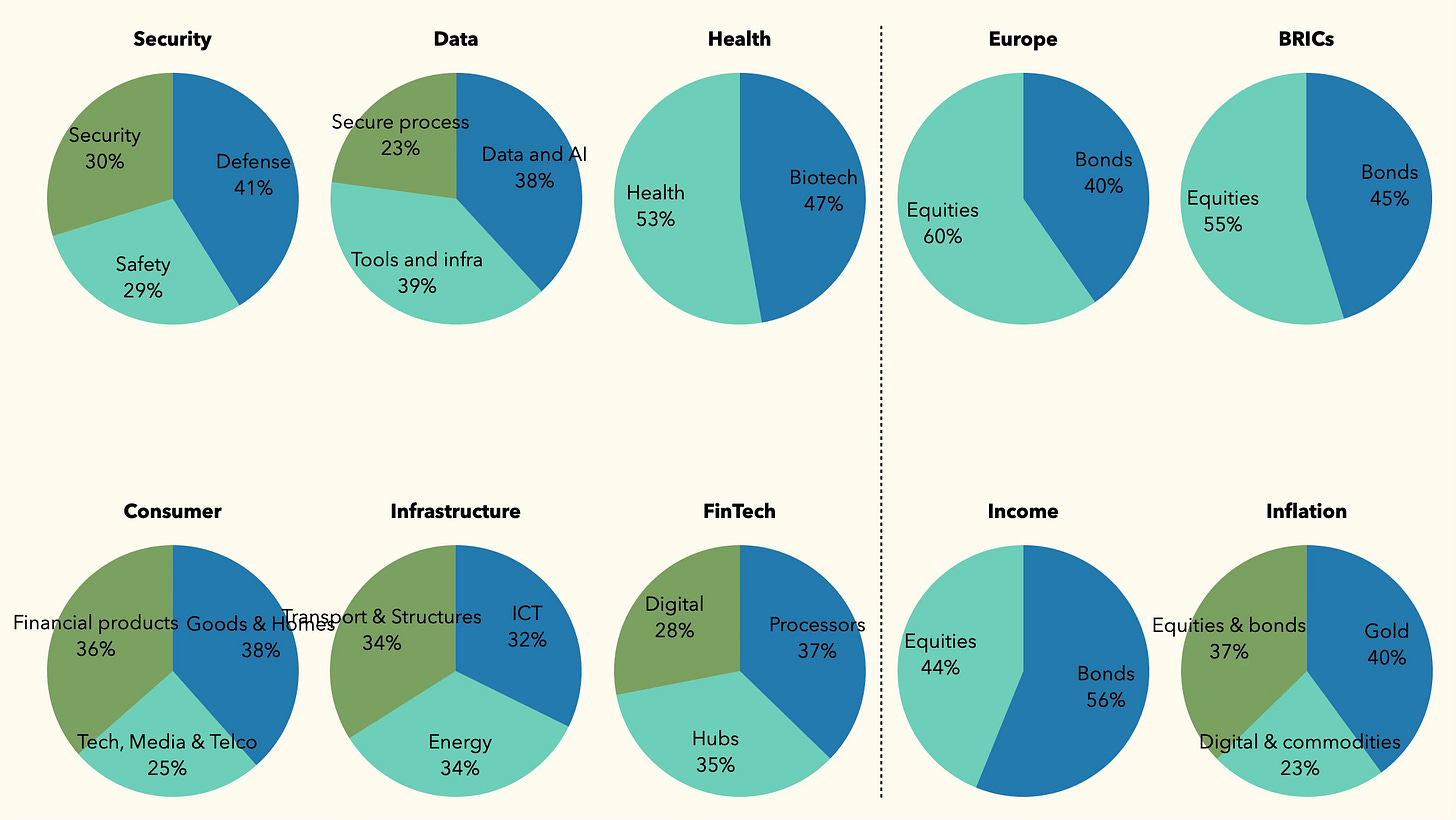

Similar picture was in thematics. The riskier pure equity US-centric themes shined, while our more defensive unique multi-asset and quasi-equity infrastructure portfolio were less positive. However, all our thematic portfolios delivered positive results. For our competitors, however, some equity themes, such as healthcare technology may have been negative, as the average of the four health tech peer funds that we follow.

Our Ai, Quantum and Data theme was the best performer in May. Earlier in May we wrote that we believe that Quantum technology is at an inflection point and the time for investors to act is now. Accordingly, we started a quantum company position in what was then called Ai and Big Data portfolio, and renamed it Ai, Quantum and Data portfolio as we intend to grow the Quantum allocation. This portfolio benefited later in May as the first Quantum Computing ETF (QNTM) was launched in Europe on May 21, which led to a spike in volumes and price for our holding.

Our Consumer Brands theme dormant until May has sprung into action, delivering +10.8% return in USD, as many of our luxury, consumer tech and finance holdings were up in double digits.

Our Financial Technology theme, up +10% benefited from crypto and associated stocks resurgence, as for example Ethereum was up over +44% during the month.

Our Security and Safety theme continued its excellent April run with +8.7% return in May. It remains our best performing portfolio year to date, up over +22% in USD.

Our unique multi-asset and infrastructure themes continued their steady positive performance. They have proven to be less volatile and less risky than pure thematics and hence delivered less positive results in a month when riskier assets rallied. As expected they outperformed fixed income, delivering +2.5% return in May in USD.

For the year to date, our unique multi-asset and infrastructure themes outperformed our pure equity themes with the return in USD of +13.1% in comparison to our overall themes average of +11.5% (and competitor themes average of +4.4%). Among these, our Infrastructure, Inflation Buster and Europe Renaissance portfolios remain in the lead.

Disclosure

My articles represent my personal opinions and are provided for information purposes only. Their content is not intended to be an investment advice, or a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. I use information sources which I believe to be reliable, but their accuracy cannot be guaranteed. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors and, if in doubt, an investor should seek advice from a qualified investment advisor.