AI, Data and Quantum now the best performing theme in 2025

Up +45% year to date

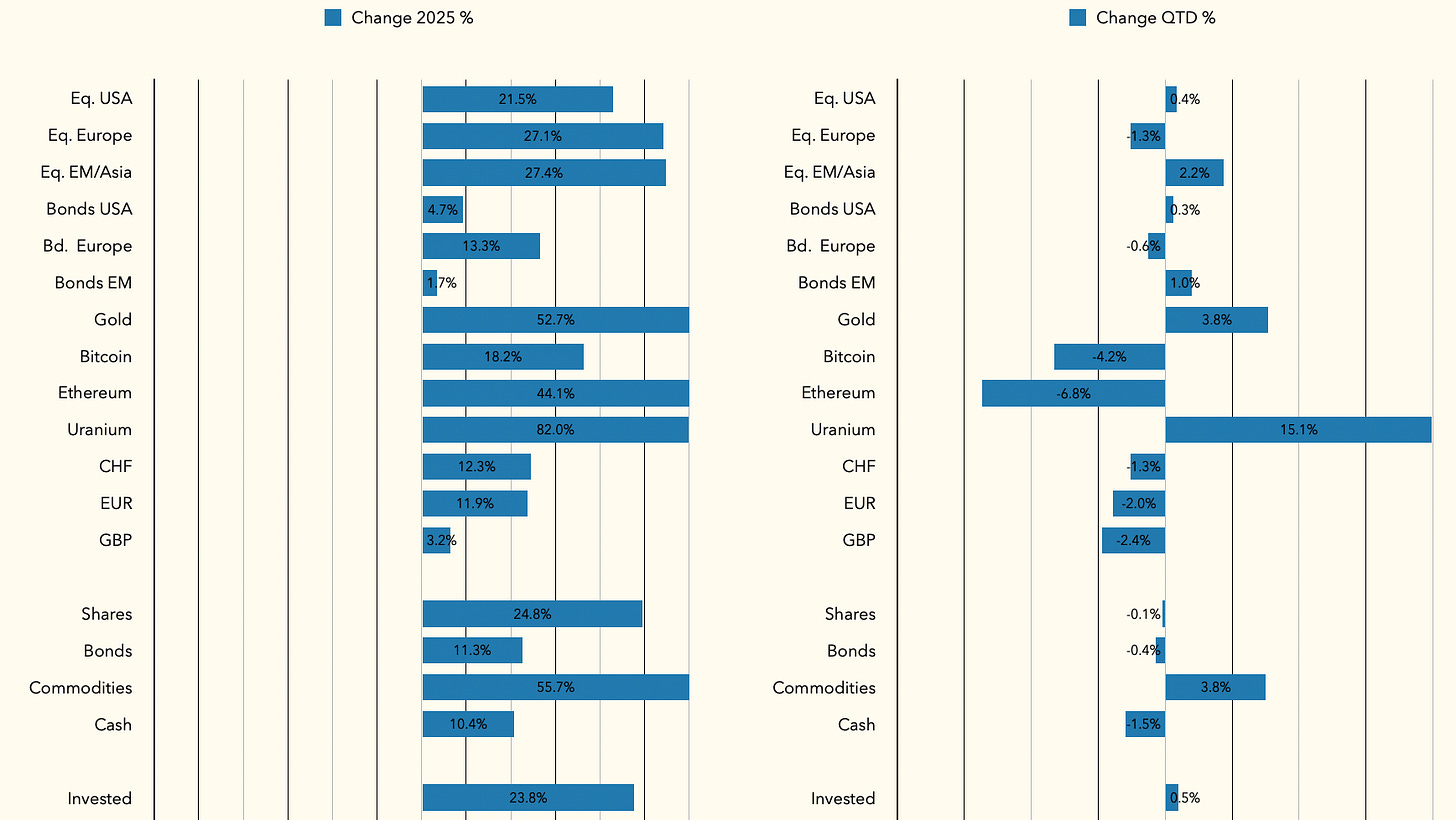

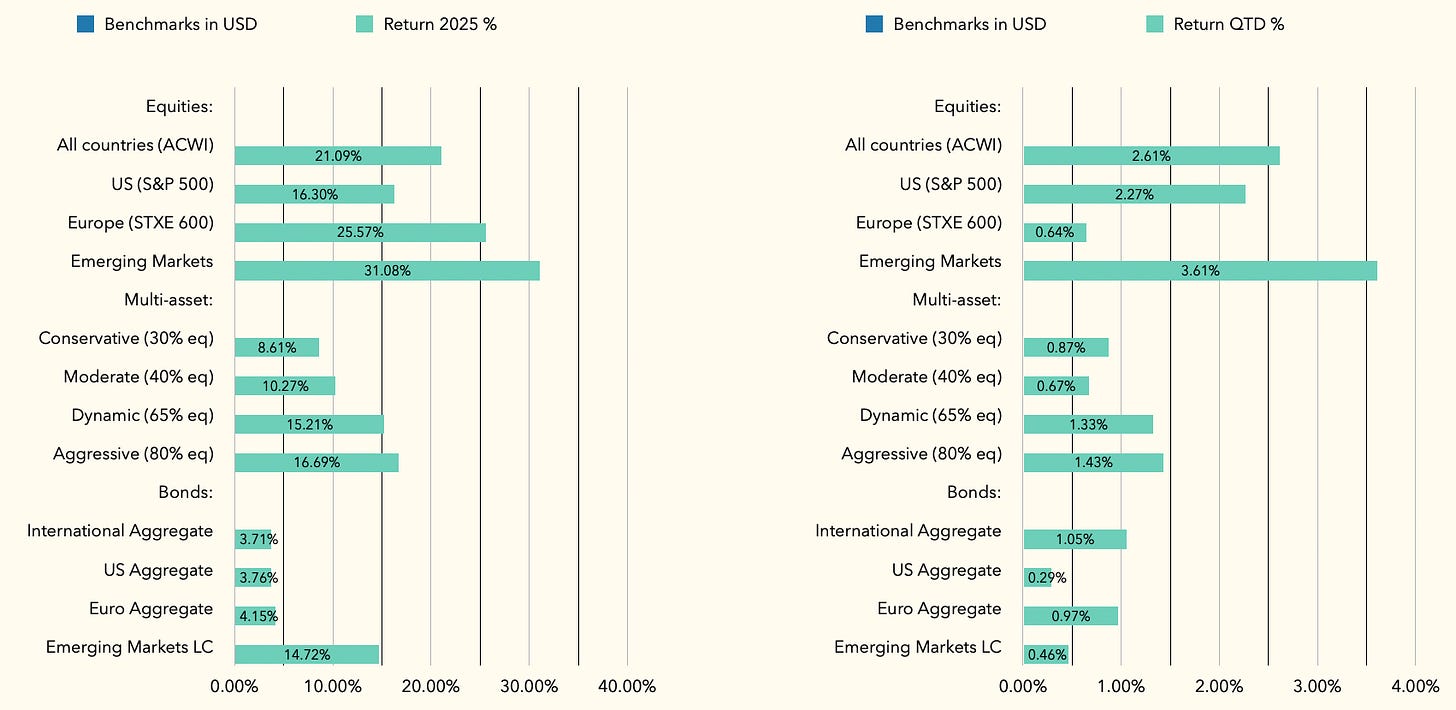

Commodities +3.8% were once again the standout performer in our multi-asset strategy portfolio, which was up +0.5% in October .

Within commodities Gold was up +3.8%, while Uranium +15.1% cancelled out the underperformance from Bitcoin -4.2% and Ethereum -6.8%.

Our equity -0.1% and bonds -0.4% allocations delivered negative performance, in comparison to benchmarks (+2.6% and +1.1%, respectively). This was to a large degree result of the negative impact from strengthening US dollar by 1.5% vs European currencies, where we have more exposure.

Overall year to date, we are still comfortably ahead of all benchmarks, and our multi-asset strategy portfolio is up +23.8% for 2025 YTD (vs equity benchmark +21.1% and bonds +3.7%). Our commodities allocation played a major role in this.

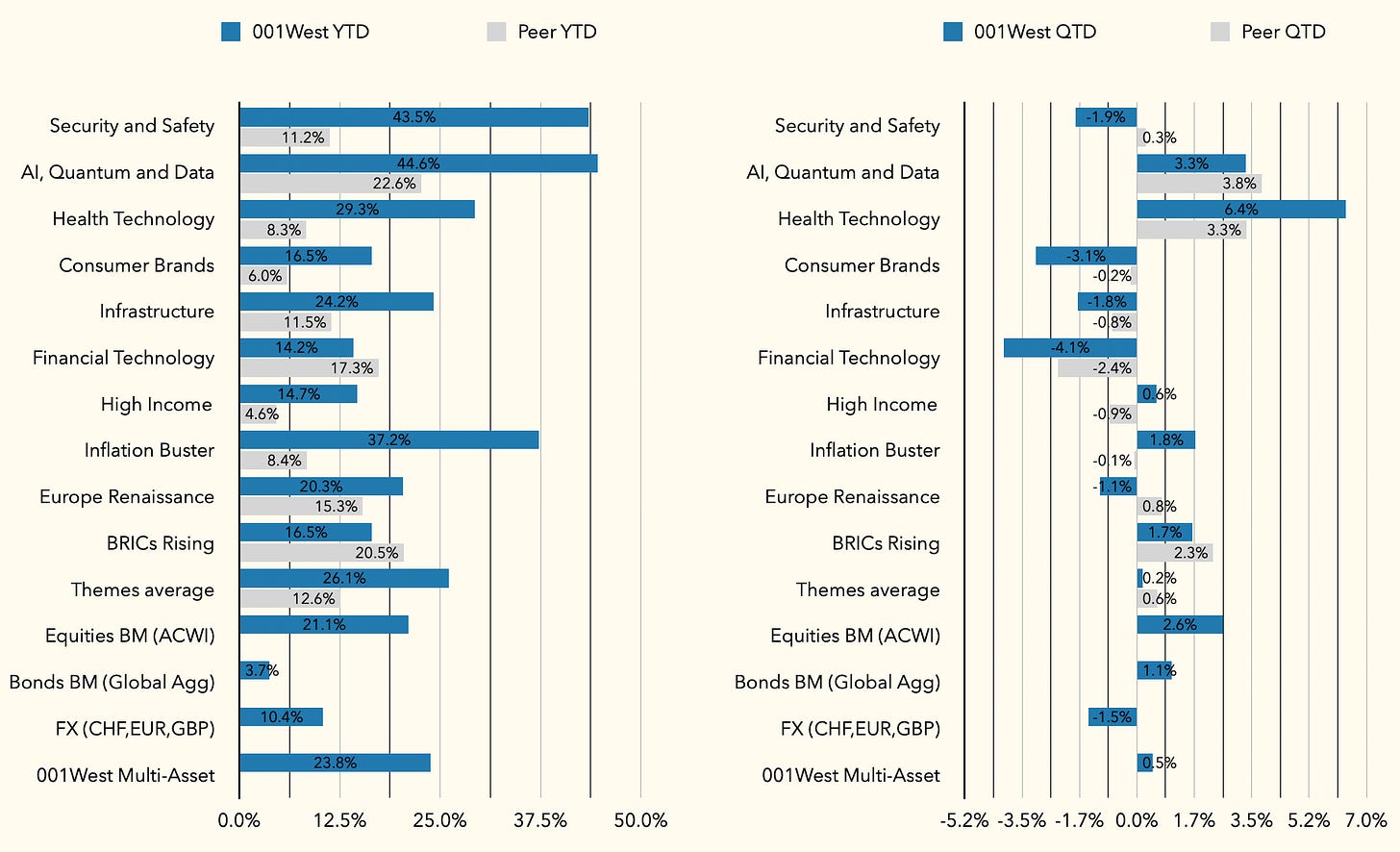

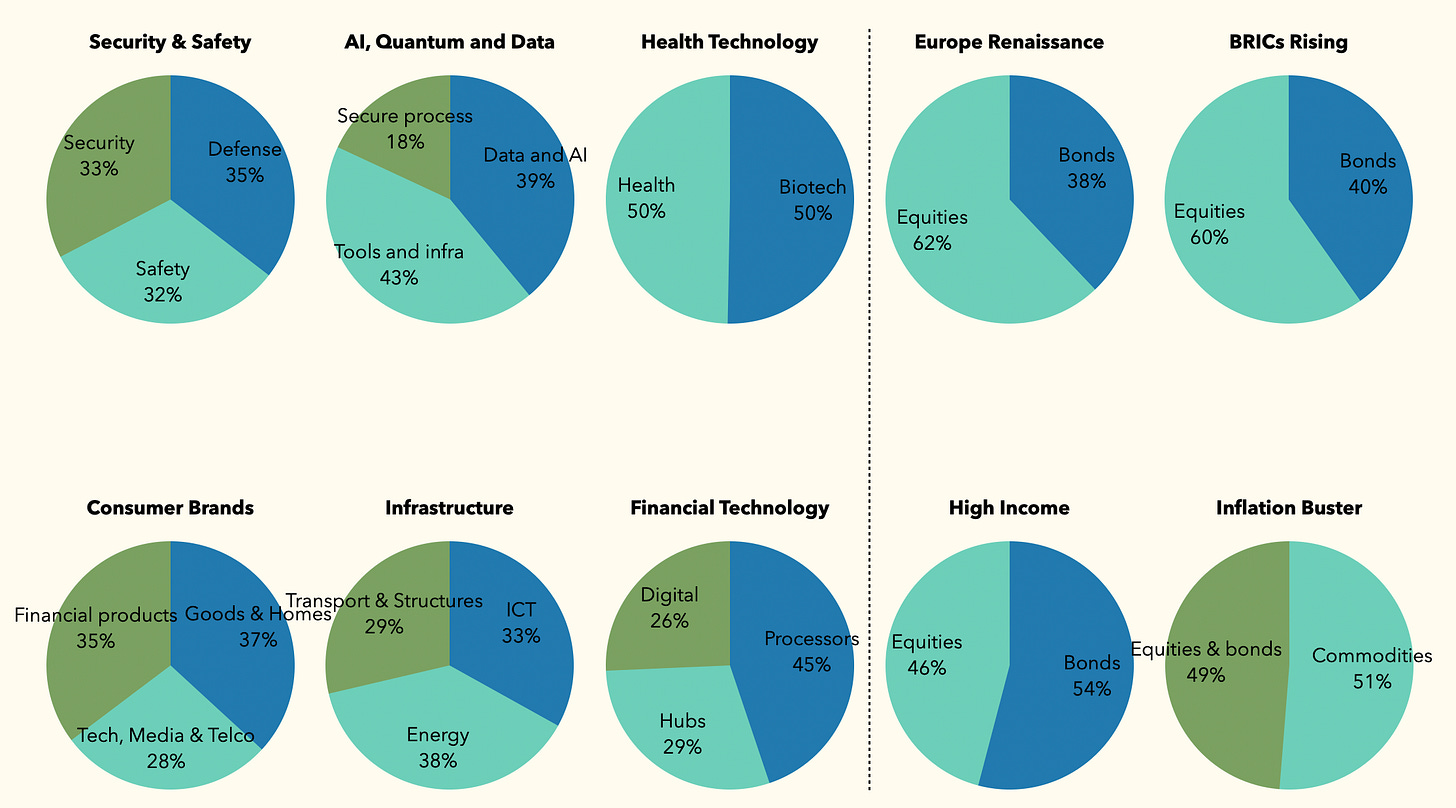

Thematic portfolios

Our thematic portfolios overall were up +0.2% in October, below peers and below +2.6% for equities and +1.1% for bonds. Currencies had a major negative impact as US dollar strengthened further against European currencies which we overweight.

Best in October: Our Health Tech portfolio continued its outperformance from Q3, up +6.4% in October and now up +29.3% for 2025 YTD.

AI, Quantum and Data was up +3.3% in October and is now the best performing theme in 2025 YTD up +44.6%.

In contrast, Security & Safety has given back some of its earlier performance, -1.9% in October but still very impressive +43.5% in 2025 YTD.

Our multi-asset Inflation Buster portfolio also continued its good performance. It was up +1.8% in October and is now up +37.2% in 2025 YTD.

Disclosure

My articles represent my personal opinions and are provided for information purposes only. Their content is not intended to be an investment advice, or a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. I use information sources which I believe to be reliable, but their accuracy cannot be guaranteed. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors and, if in doubt, an investor should seek advice from a qualified investment advisor.