+25% 2025 YTD

...and check back on our predictions made a year ago

Our main call was preference for all European assets including equity, bonds and EUR. We also advocated for gold and CHF as a hedge.

The year is almost over and it’s time to check how these predictions have panned out.

This main call is proving to be correct:

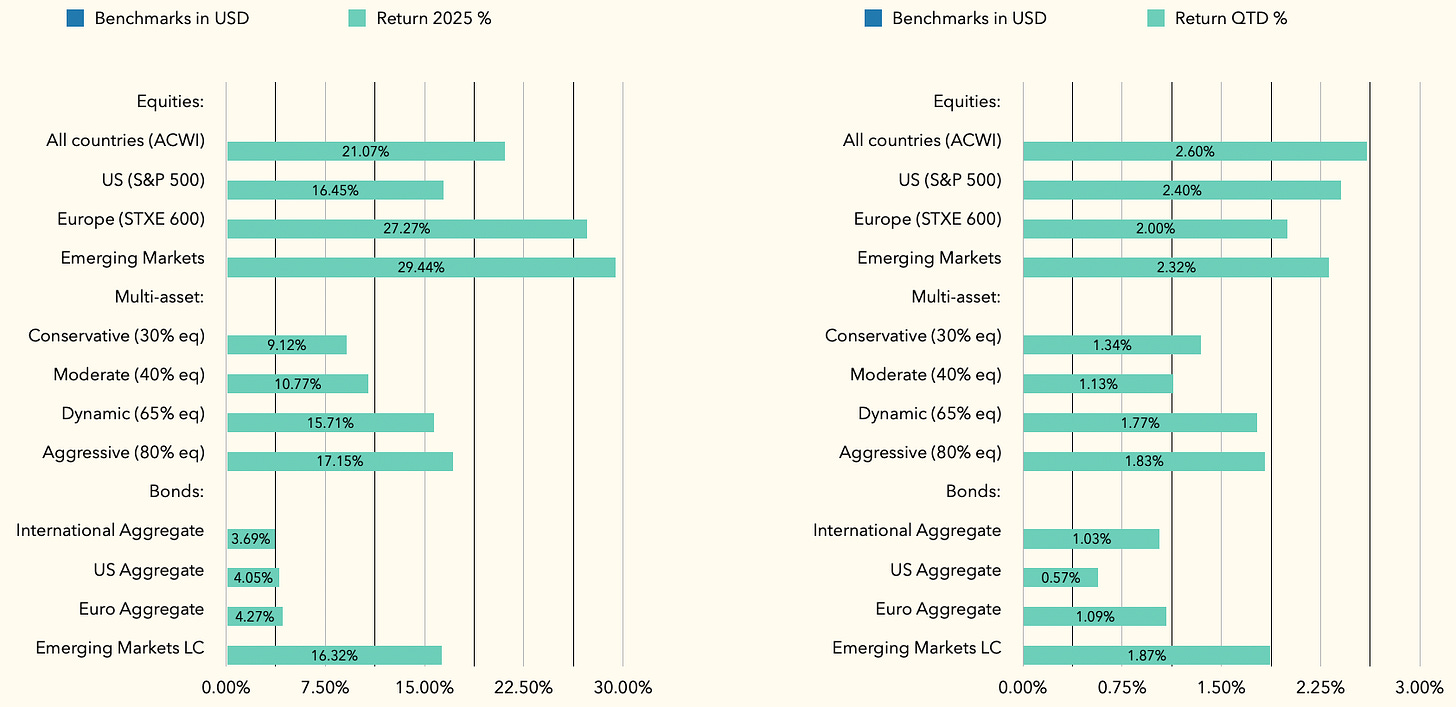

European equities index outperformed US equities index delivering +27.3% vs +16.5% YTD, respectively in USD. Our European equities selection delivered a slightly better +28.3% and our US equities selection a much better +22.1%.

European bonds benchmark slightly outperformed US bonds benchmark delivering +4.3% vs +4.1% YTD, respectively in USD. But our European bonds selection delivered much better +13.8% vs +5.7% for our US bonds selection.

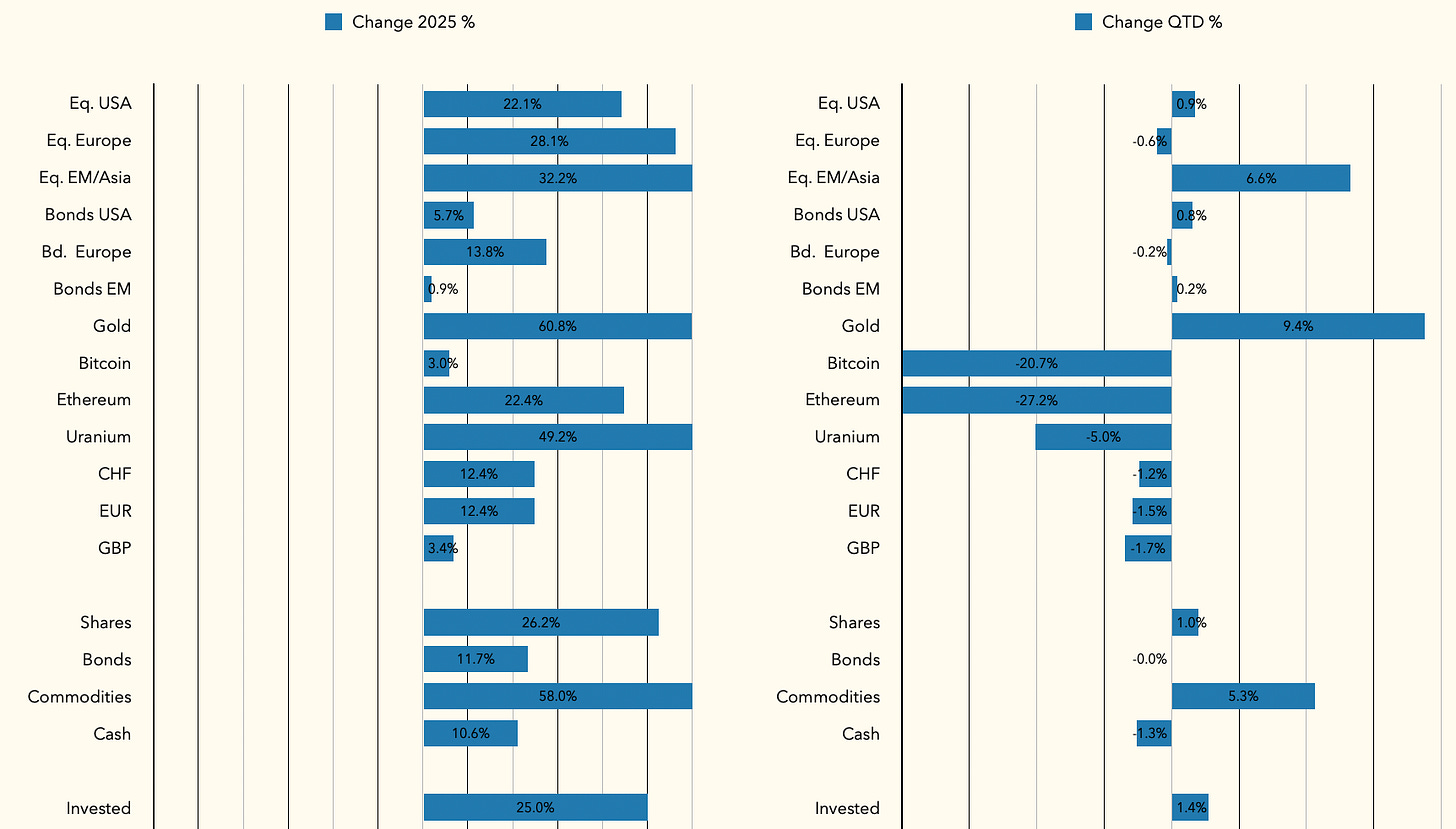

EUR strengthened vs USD by +12.4%, same as CHF. Gold proved to be an outstanding hedge against weak dollar, strengthening by +60.8% vs USD.

Our multi-asset strategy portfolio performance

Unusually, all our investment classes are in positive territory. Overall, our multi-asset strategy portfolio has returned 25%. This is roughly twice the return of a typical multi-asset portfolio with moderate to dynamic equity allocation, i.e. like ours.

Main reason for such a significant outperformance is our additional allocation to commodities, with majority in Gold. Our commodities portfolio returned 58%, our equities allocation returned 26.2% and bonds 11.7%.

Our commodities basket includes Gold +60.8%, as well as Uranium/nuclear +49.2%, Ethereum +22.4% and Bitcoin +3%.

Our equities basket was up +26.2%, which compares to +21.1% for the all-countries equities benchmark ACWI. Within equities our US allocation was up 22.1% vs S&P500 +16.5%; our European equities basket was up 28.1% vs STXE600 +27.3%; and our EM basket was up 32.2% vs EM benchmark +29.4%.

Our bonds basket was up +11.7%. This includes US bonds +5.7% vs +4.1% for the US bonds benchmark; our European bonds basket +13.8% vs European bonds benchmark +4.3%; and our EM bonds +0.9%.

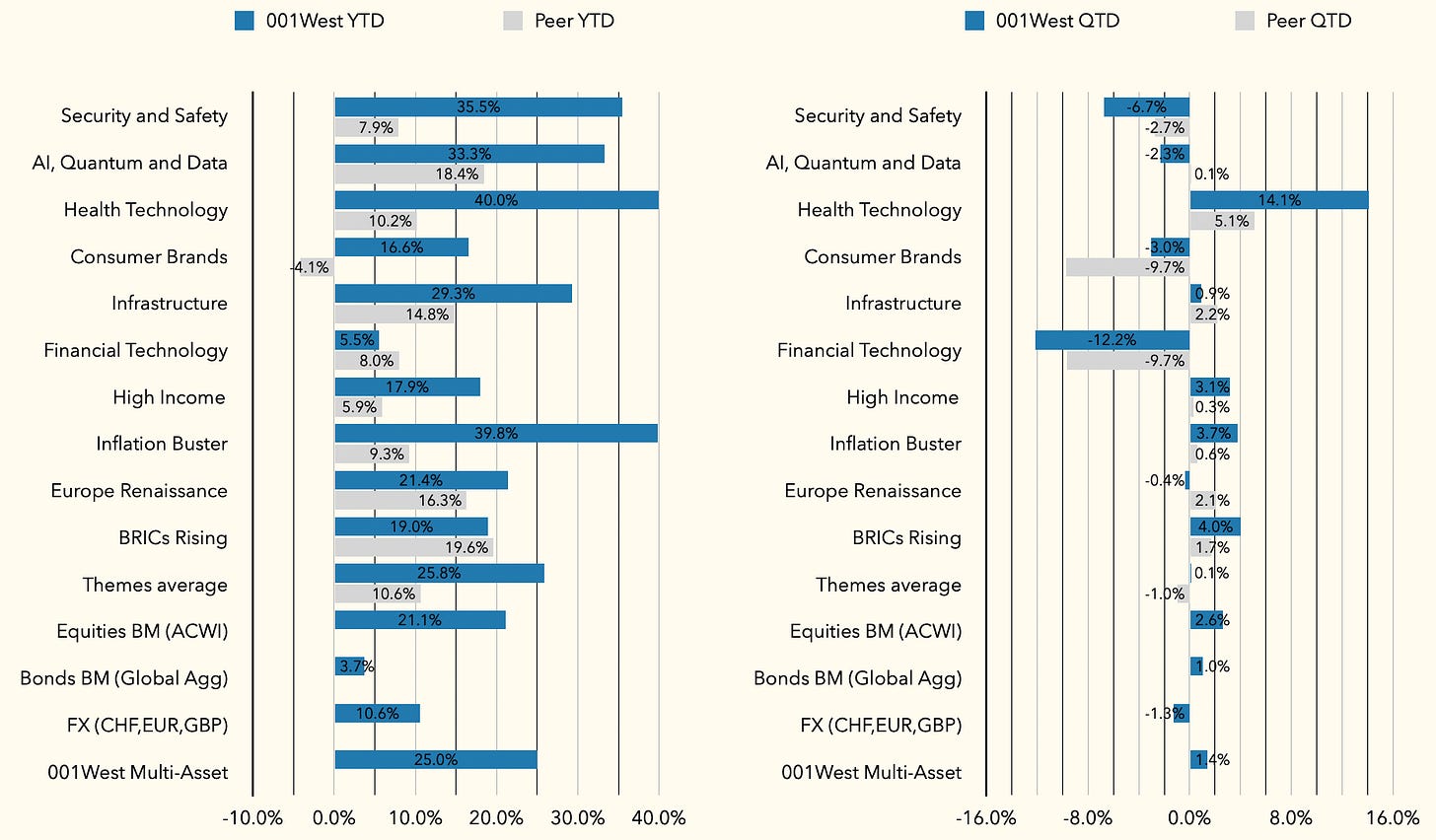

Thematic performance

This seems to be the case. The average of thematic equity funds that we tracked was +10.6% return, half the +21.1% return of general equity index. Our own thematic portfolios, however, delivered +25.8% return, beating the general equities index.

Among our thematic portfolios:

Heath Tech was the best theme YTD up +40%, roughly 4x better than peers;

Multi-asset Inflation Buster was up 39.8%, also 4x better than peers;

Security and Safety and AI, Quantum and Data were up over 30%;

Infrastructure was another theme beating equities with 29.3% return.

Q4 2025 so far

Last quarter of 2025 is proving to be risk averse.

Among our investments, the riskiest ones, such as Bitcoin and Ethereum, are selling off the most. While the most defensive, Gold, continues to shine, up another +9.4% QTD. Interestingly, equities, which are typically riskier than bonds are outperforming, within our selection this is primarily driven by emerging markets.

Looking at thematic performance, we can see the same pattern. Riskier thematic equities portfolios are selling off, and the riskiest among them, FinTech is selling off the most. In contrast, our unique multi-asset portfolios are proving to be defensive, showing the same resilience which they demonstrated during difficult Q1’25.

Disclosure

My articles represent my personal opinions and are provided for information purposes only. Their content is not intended to be an investment advice, or a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. I use information sources which I believe to be reliable, but their accuracy cannot be guaranteed. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors and, if in doubt, an investor should seek advice from a qualified investment advisor.